All traders know about technical indicators – frankly speaking, the vast majority of traders constantly use them in their strategies and trading advisors. Forex technical indicator is in fact a graphical display of calculations and formulas. Principal values used for all calculations are, of course, price and time, and sometimes volume as well. Trading computerization has overshadowed the indicators’ inside, and market participants don’t even need to know how and on what basis an indicator is built. The main thing for a trader is to understand what type of Forex indicator they use, and what signals it sends. This article will review the main types of indicators, and cases in which they are worth using.

Today, regardless of the trading platform a trader uses, they can always count on a vast arsenal of indicators. Almost any Forex technical indicator can be found online and get installed. All technical indicators can be divided into three groups: trend indicators, oscillators and volume indicators. Normally, the trading platform includes several kinds of each type of indicators.

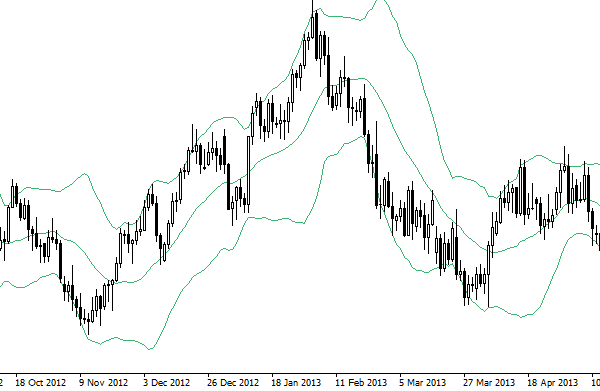

Forex trend indicators are used by traders to determine the current market trends. Trend indicators can inform the trader that the market is growing, falling, or in a side phase. We can say that this group of indicators is the most popular, because trend trading is not just very profitable, but also safe. The trend indicators behave best in the long term perspective, as the market noise is virtually absent, and it is easy to determine the trend even with the naked eye. As you've probably realized, a disadvantage of these indicators is a late entry into the market. The indicator signal of the trend forming normally comes when the main phase of growth or a major impact has already occurred. Trend indicators include Moving Average, Bollinger Bands and ADX.

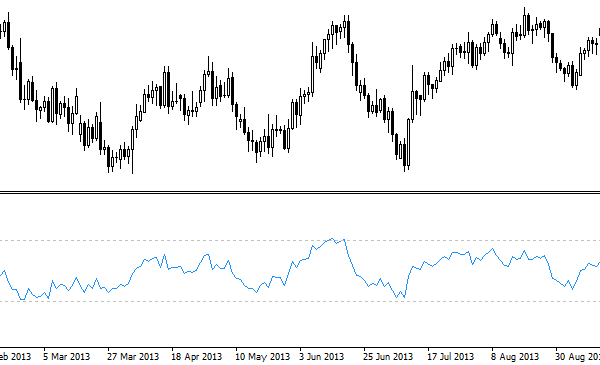

The next group of technical indicators is oscillators. They outperform trend indicators in accuracy and timeliness. The essence of the oscillators is forming overbought and oversold levels. In simple words, a Forex technical indicator-oscillator informs the trader when the market has significantly grown or decreased compared with historical data. But therein the weakness of this indicator lies: due to the fact that the market is constantly changing, it may go off scale at reaching new highs and lows. Therefore, you should understand that oscillator signals are not 100% accurate. The best work field for this type of indicators is sideway trends and trading ranges: the oscillators tend to show high efficiency if constraining borders are set. Popular indicators-oscillators are Stochastic and RSI.

The last type of indicators in the Forex market is volume indicators. Volume indicators provide buyers and sellers with information on the number and volume of deals in a given period. These indicators help to understand who dominate the market – the bulls or the bears. Volume is one of the most important variables in trading, and many professional traders use it in trading. It is worth noting that this group of indicators is poorly represented in the popular MetaTrader trading terminal. Speaking more precisely, a technical Forex indicator lacks such deep significance due to the specific of currency pairs. You can best keep track of the volume by focusing on currency futures.

With the development of the foreign exchange market, technical Forex indicators have also improved, and a lot of new and more advanced technical analysis tools have been created. They divided into 3 main groups of indicators reviewed above. Common practice is to use several indicators of various types to filter or confirm signals. Indicators have become an indispensable weapon for traders and help them make a profit every day.

Social button for Joomla