In today’s publication we’ll review another future indicator called FuturoFx, which projects the expected movement to the near future based on past data. By its principle, it is similar to a well-known CTG-Structure, but with the provided possibility of the explicit detalization of the current situation.

We’d like to remind you that any future indicator must meet several criteria. First, the formula should have a logical and clear justification, secondly, it is desirable that for each forecast the probability was worked out, and thirdly, the opportunity to check the work on history must be provided. Given the listed rules, we’ll explain in more detail whether the reviewed forecaster is really so good.

Traditionally, we’ll start with the settings. The main parameters are «Look Back» and «Look Forward», through which the number of bars for the analysis in each block and for the projection of the future are set, respectively. Other variables are designed for fine-tuning, we’ll list them briefly:

- Max_history – the number of bars for future indicator to analyze;

- Correlation_Data – at what process the models are compared, each letter is the first of the price name, such as O – Open, supports all standard options;

- Cor_Threshold – filter by coincidence, if the formation coincides with the history by a given percentage, it will be taken into account;

- Interface settings block – intuitive, you should pay attention only to Display_Options, which regulates the set of graphic elements, in particular, T – blue window, A – average forecast, B – the most optimistic scenario, R – red frame of the studied blocks;

- Window Screenshot – for any positive number of “x”, the algorithm will save the screenshot of the working desktop every “x” bars to a “files” folder.

How to apply a future indicator FuturoFx into practice

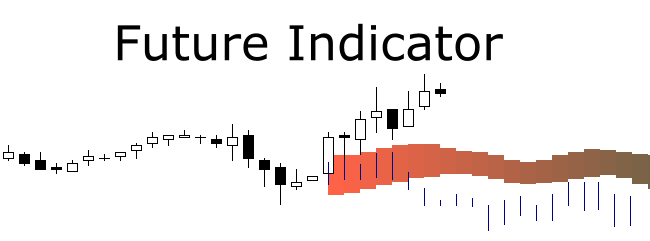

In earlier publications we have briefly mentioned that it is best to use leading indicators on small timeframes, because, given the specificity of a set of positions and strategies of major market operators, the likelihood of recurrence of scenarios from the past is higher on them. The figure below shows an example of the working window on a five-minute chart of the EUR/USD pair.

The most important element is the information window (1), which specifies: the time of the forecast update, the depth of history, the number of comparisons and the occurrences found, the accuracy of best match, the profit potential when buying and selling, and finally – the likelihood of the scenario development. The corridor, with a gradient fill (2) is the forecast, equal to the average of all the matches.

Future indicator FuturoFx endears with its simplicity and pithiness – in fact, you don’t need to analyze anything, just open the deals, but in reality, the problems arise within the first minutes of work, the main one being a redrawing. Despite the fact that the function of creating screenshots is provided, it is very difficult to work in real time, because after just a few bars, the situation may change significantly, and it becomes not clear whether to close the newly opened order, or to wait for the previously mentioned goals.

With this in mind, the strategy with FuturoFx needs at least two more tools – a trend one and a signal generator – and the “forecaster” itself will become just a filter of the potentially dangerous situations, i.e. it becomes a good helper not in setting goals, but rather in the fight against excess stop-losses. In conclusion, we can say that if it was not about redrawing, the considered algorithm could have been one of the best in its niche.