Currency index indicator is the result of averaging the quotations of several pairs containing the necessary currency as the base or quote. Scope of these indices application is quite extensive – from analysis and speculation to portfolio investments, but first things first.

To be able to understand how to use the index indicator, it is necessary to answer the question: what is it? If you speak the language of statistics, it is the weighted average which characterizes the objective value of the currency. Before turning to strategies, let’s deal with theory first.

Classic dollar index indicator: application in trading

The leading currency in international settlements is the U.S. dollar. Obviously, it depends on the trends in the global economy and the Fed’s policy, so the rate trend will depend largely on these factors. At the same time, some pairs are strongly dependent on national governments and liquidity, and thus the attempt of trading on a single pair excluding the main currency trend as a whole may result in losses due to the high probability of “accidents”. Indexes solve this problem.

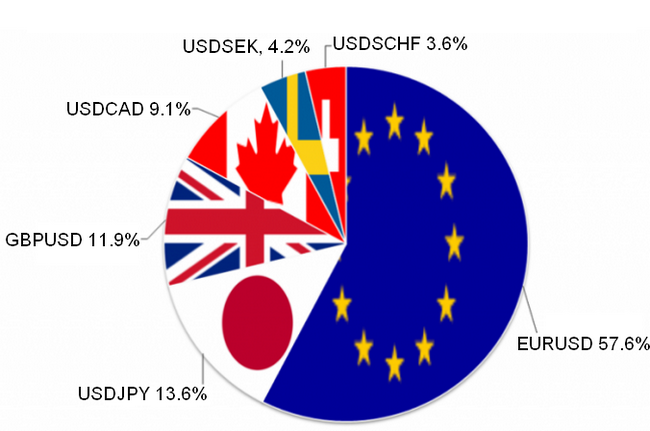

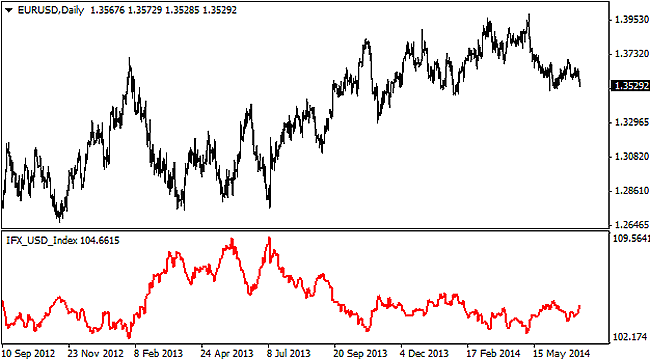

At the moment, there is no need to necessarily install the dollar index indicator, as almost all dealing centers provide financial futures quotes on the dollar index DXY, trading with which first became available in 1985. Nevertheless, an example of the USDX indicator of the EUR/USD pair chart is presented below:

You may notice that the values differ from those of the DXY financial futures, but that's okay, and in this case only dynamics and history availability matter. So, even according to the above schedule it becomes obvious how to use it – primarily for marking areas of support/resistance:

Vertical lines mark the situations where the market was testing the strength of the area of support for the U.S. dollar. Since the index is stronger than a single pair, given the disparity in the levels, in this situation it would be reasonable to assume that the dollar is undervalued against the euro.

How else can index indicator apply?

If the above-considered method is universal and can be even applied intraday, the alternative interpretation of the preconditions of the reversal is a study of the divergences that give quality signals only on large timeframes. The situation clearer than the example presented above does not come up – while the euro updates new highs, the dollar index doesn’t go beyond the support boundaries:

In addition, one of the most reliable strategies is to manage a portfolio of currency pairs. In this case, the currency index can greatly simplify the work because it replaces complex techniques based on correlation, all you need is to buy undervalued pairs and sell overvalued relative to the index, of course, the entry points must be determined from the levels and areas.

Another way to collect a portfolio is to work on all the instruments only with the index trend, opening positions from the local extremes. The advantage of this trading is as follows: random fluctuations on a single pair are not taken into account, only the dynamics of the index is important, and hence the overall financial result, while stop-losses are only set virtual on the index. Thus, the trader protects against losses due to news and other “information noise”.

There are also disadvantages of such tactics – in particular, first of all, you need additional scripts and expert advisors that would “trawl” the total position, and secondly, hedging is not used, as in the previous version.

Social button for Joomla