Many newcomers hope to find a way to get easy money and are looking for secret Forex indicators, believing that the formula able to "crack" the market has already been invented. Such assumptions result from limited experience, and sometimes from the unwillingness to study. In fact, the situation with indicators is different, so we will review stereotypes, misconceptions, and options to find hidden opportunities in the indicators.

Secret Forex indicators can’t by definition be found online, otherwise they are no longer secret – this important point should be taken into account while learning to trade. A simple truth results from here: everything found on the network with such slogans is just an advertising aiming at selling well-known methods.

By a long stretch of the imagination you can say that the secret Forex indicators use miscalculations of a particular dealing center (hereafter DC) – for instance, import quotes from other companies with special programs, and provide leading signals if the quotes are delayed. But this approach doesn’t have any scientific basis and is in fact a common abuse of technical failures.

DCs tackle such algorithms with both the use of software and zeroing of the profits received, so all the "secrecy" has long been known and will cause unnecessary problems. Although DCs compete, their security departments may share information regarding such clientele, so if the trader was caught in one company, the chances are that he immediately gets on control after creating an account in the other one, and is treated appropriately.

Secret Forex indicators as a synthesis of standard techniques

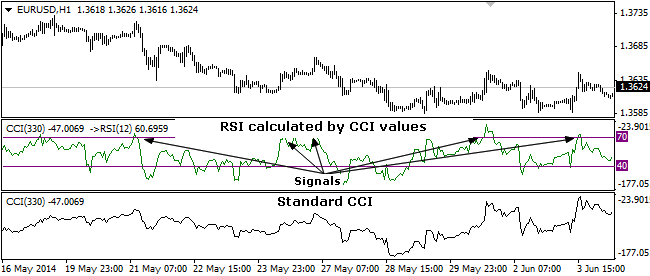

Any novice trader, who has studied the terminal, can come up with their own secret techniques based on the standard indicators, without studying programming language. An example is the synthesis of the Commodity Channel Index and the Relative Strength Index into one. It is for certain that someone has already written such an indicator and keeps it a secret, or it may already be found online under an unfamiliar name – the details are not important, we just need to show by example how to look for opportunities where they don’t exist at first glance.

CCI is regarded as an effective trend indicator, while trading from the extremes often fails (though is often discussed). This disadvantage is eliminated by calculating the force index of the Commodity Channel rather than the actual deviation. In the chart, this operation looks this way:

You may notice that the signals are much more accurate than when trading from the CCI extremes. Of course, such operations are not classified as secret, because the terminal provides the ability to calculate the indicator by the indicator, but few people use it or even know it exists in MT4.

To summarize the abovesaid, we will briefly list the features the secret Forex indicators should have to be called so:

-

they aren’t sold or advertised online – as a rule, such an algorithm can be bought from a programmer you know in person in a single copy;

-

usually fraudulent schemes are passed off as Grails, which generates a conflict of interest with DC, so the correct indicator uses only one quotations supplier;

-

everything efficient and unknown is an original combination of old methods – therefore, an efficient algorithm is a simple solution; the more complex it is, the less likely it is working.