Most of us in one form or another use representatives of the moving average family in our trading. But the main problem of all indicators built on the mathematics of averages is lagging. Effective solution to this problem was found by many experiments and named Hull Moving Average indicator or Hull moving average.

Traders use indicators based on averages to build dynamic lines of support/resistance and assess the strength of price momentum. Their main disadvantage lies in the method of calculation: since moving averages are calculated based on past prices (for a certain period of time or number of bars), the calculated line reduces price fluctuations, but will always lag behind real price.

Alan Hull, an Australian mathematician, financial analyst and hereditary trader, member of the Australian Association for Technical Analysis (turns out this one exists!), author of the popular textbook “Active Investment” and “The Book of Charts”, proposed an improved version of the moving average, providing smooth indicators in the construction and almost completely eliminating the negative effect of lagging.

What are "moving averages"?

This is one of the oldest tools of technical analysis, which helps to identify the strength and direction of the current price trends to ensure optimal conditions for the trader to open a trading position along the trend. Even the father of the trading chaos, Bill Williams, believed that the ability to use the indicators of moving averages would allow speculators to close not less than 60% of the positions at plus.

Traditional Moving Average (or MA) is calculated very easy: at every point of the line, the price is the average price for a specified time period. By averaging, the random price surges are cut off, and the longer the period, the more accurate the line. Optimum period of moving average should be picked up separately for each trading instrument. Classical average always quite accurately follows the market, because the calculation is based on historical data. However, the common average is a very weak predictor – Moving Average calculation method does not allow to calculate the moment of the trend change.

Here comes in a modified average – the Hull Moving Average indicator.

Mathematics of Hull Moving Average indicator

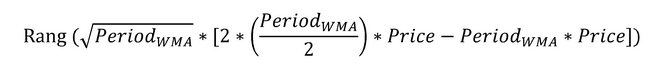

More harmonious smoothing in calculating this moving average is provided by an additional "averaging" of the average. The proposed version of the indicator solves the problem by incorporating the value of not the period, but rather of the square root of the actual data of the calculation period into the mechanism for calculating. But in this case, the moving should further lag behind the real price! However, Alan Hull managed to find the missing ingredient that effectively compensates for the delay.

Hull applied the method of weighting coefficients to the market price calculation, where in a raw from 0 to 9, the number 9 is given the greatest importance. The calculation starts with the determination of the values of the simple moving MA (10): in result, we get the initial average value 4.5, and it gives a serious lag behind the actual price. The next step is halving of the average (10/2 = 5) and applying it to the last value in the listed row: 5, 6, 7, 8 and 9, after which we get a new average – 7. This value is then added to the difference between these two averages, i.e. to 2.5 (7 – 4.5), and we get the final amount – 7 + 2.5 = 9.5.

If we assume that the current market price is equal to 9, the resulting compensation seems exaggerated. However, the author considers this overcorrection very convenient for reducing the influence of random price surges. Price change with the help of a Hull moving can be predicted with high accuracy for 1-2 selected periods. Visually, the moving line is usually faster than the value of the real average.

In general, the formula for calculating the values of the Hull Moving Average indicator is as follows:

Hull Moving Average indicator: parameters and settings

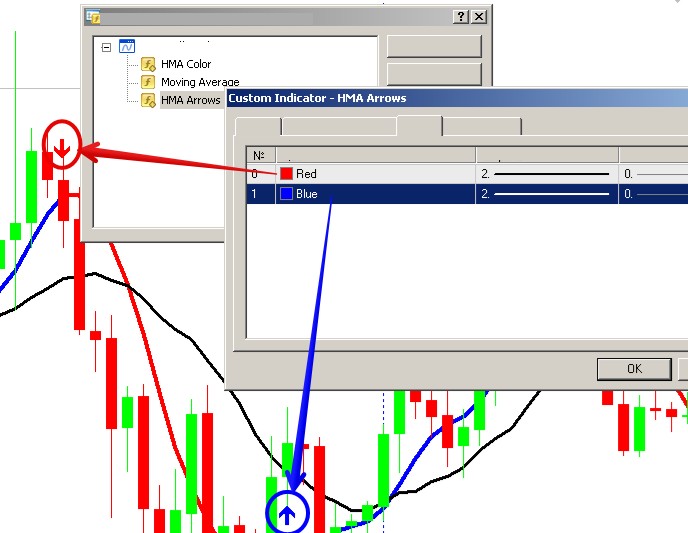

There are several options of using the modified average, but it is usually recommended to use it together with an arrow indicator HMA Arrow, clearly indicating the recommended entry point.

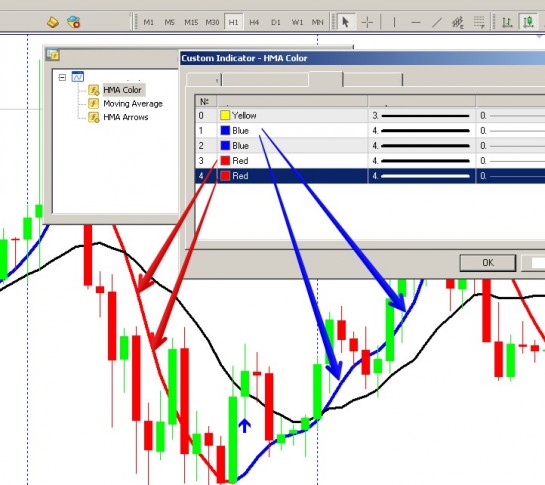

Hull Moving Average indicator is installed in the terminal MetaTreder4 in the usual way, on any currency pair and any timeframe. Recommended settings and optimal colors are shown in the figure below:

Hull modified average works well on short and medium periods, the most stable results are provided on periods of greater than 20. The optimal values are considered the following key parameters: HM_Period - 20; HMA_Method (shift) - 3.

Sometimes the following setting can be recommended for the quieter medium-term trading with small risks: HMA_period - 55; HMA_shift – 3. However, the recommended entry points will appear less frequently.

Settings of the additional HMA Arrow indicator are very simple:

Pros and cons of applying the Hull Moving Average indicator in trading

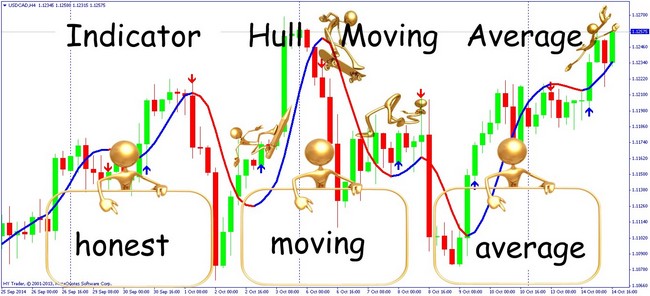

For clarity of the analysis, a simple moving average SMA (14) on the closing prices (black line) was added on the chart with Hull Moving Average and HMA Arrow indicators. General view of the set of indicators in the terminal:

As can be seen, entry signals appear sufficiently accurate, particularly in comparison with the common average. But do not forget about the main disadvantage of the Hull moving: the current trend to overestimate the value of the average price leads to the fact that the line does not match the current average price. It works well as a reversal filter, and, therefore, its exit signals are more reliable than the entry. So, Hull Moving Average indicator is required to be combined with options of oscillators or MACD. But even without the use of additional arrow indicators, there is a high probability of a signal to buy when the price crosses the indicator line upwards and to sell if the price goes downwards.

The most effective strategy is considered Hull_Moving_Average by Alan Hull, built on a standard market surveillance. Trading signal is considered to be a reversal of the Hull line: if there is a turn down, short positions are recommended, if up – long positions. At that, however, this "breakthrough" by the price of the line of the Hull Moving Average indicator itself is not perceived as the market signal.

And as a conclusion...

The methodology of calculation of the Hull Moving Average indicator is based on the modern mathematical mechanism that greatly improves the smoothness of the line and accuracy of market signals. Line of the HMA average excellently tracks the trend and gives accurate reversal signals. Inherent superiority of the average value in the calculation leads to an overestimation of the current average price, but with the optimal settings and additional indicators, you can get a trading strategy with a win rate over 60%.