After getting familiar with the terminal and the basics of technical analysis, almost every novice speculator has a question: what indicators the professionals use and whether they use them at all. We have a straightforward answer: they do.

Before we start to find out what the professional Forex indicators are, we would like to remind you of one fact: any of them is just a mathematical formula which works with the price, but can predict nothing. Therefore the interpretation of the results received is the task of a trader. Below we will focus on the professional approach to building of the indicator systems, and review major groups of useful indicators.

Let us note that there are thousands of different codes in public access in the vast worldwide web, but the professional Forex indicators should meet several essential criteria. First of all, the algorithm must be simple and intuitive for the user. If the formula is impossible to understand, or it is deliberately hidden by the seller, then such an indicator is not recommended for use.

Secondly, it is important to have no “redraw” on history. Sometimes, after upgrading the chart or the restart of the terminal, the values of the indicator change – this is unacceptable for professionals, because, on the one hand, it is impossible to objectively and quickly assess the indicator performance in the past (it is necessary to resort to special testing programs), and on the other hand, the code has obvious errors and assumptions, which is normally used for selling non-function “grails”.

Where to look for professional Forex indicators

Of course, there are exceptions from the above rules, such as indicators on regression calculations, whose complex formulas require knowledge of higher mathematics and econometrics. You can’t reject them – instead, you should better improve your skills. These algorithms are normally unavailable for free access due to the complexity of their creation. This is why everything you need for profitable trading is usually right before your eyes – in particular, a standard set of indicators included in any terminal. In our opinion, the most efficient indicators are the following:

-

Moving Average – nothing is more important than the average price during the period: even the governments make up their budgets using average prices;

-

Commodity Channel Index – thanks to its formula, also built on the moving average, it clearly shows the trend if you use an extended period of calculation;

-

Relative Strength Index and Stochastic Oscillator – appropriate indicators to determine the correction;

-

Standard Deviation – one of the most important tools, particularly useful in conjunction with RSI, but this will be reviewed in detail below.

Actually, all of the above listed indicators are necessary for building efficient trading systems, while the rest are just their modifications and special cases. You should also pay attention to the volume indicators, which are inherently useless, because they use tick data rather than the actual volumes of futures, for instance.

Let’s review professional Forex indicators at the simplest example

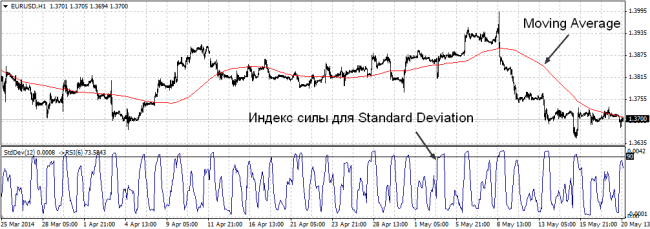

So, the figure below shows the operating window of a system created as quick as in five minutes, built on a simple moving average with a period of 120 hours (i.e. within last week) – this is a skeleton of the system, an identifier of the trend, according to which selling is allowed at a negative angle of the line inclination, and buying – when the latter is positive.

Entry points at the pullback are identified with the dynamics (pay attention to the word) of the standard deviation, the identification of which is simplified with the Relative Strength Index. The signal means the following: the impulse on the trend is followed by a sequence of oscillations in both directions from the average, and when the standard deviation begins to grow, with the price moving against the trend, we can say that the correction is coming to an end, and it is therefore reasonable to make a deal in the direction of the trend. But this is only the tip of the iceberg.

Professional Forex indicators should be used only in combination with the statistics – namely, in it necessary to evaluate several options of theoretical mean value of the strategy, with different values of the period for calculation, levels of stop-loss and take-profit, but this topic is the subject of an entirely different section.

Social button for Joomla