Signal indicators or "arrows", as they are disapprovingly called by the professionals, appear to be the simplest algorithms designed to identify specific entry points where you can buy or sell the asset in a timely manner.

In fact, this group of indicators can’t be assessed unambiguously, since they contain both the reliable experts and hastily written indicators that developers misrepresent as another "Holy Grail" in the hope that the novice and inexperienced speculator would pay money for them.

Moreover, often the apparent simplicity of the "semaphore" indicator hides complex and very interesting formula, so accusations from traders who do not use the indicator analysis to the beginners’ and even programmers' “unwillingness to think” are unfounded.

Signal indicators for the trend search

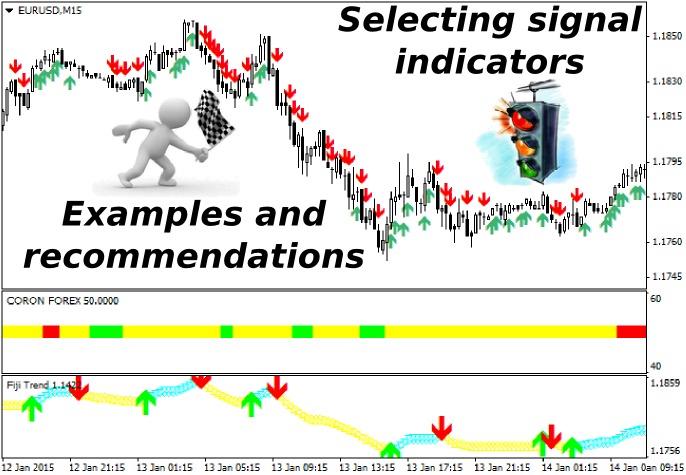

Not to delve into the theory, we’ll just look at some algorithms and start, of course, with the trend indicators. It should immediately be noted that almost all of them are written on the basis of standard experts included in the installation package of any terminal, and are only intended to simplify the process of searching for a trend reversal, while the developers try to combine several formulas in a single expert in order to improve the accuracy of signals. A classic example of this approach is a Fiji Trend indicator.

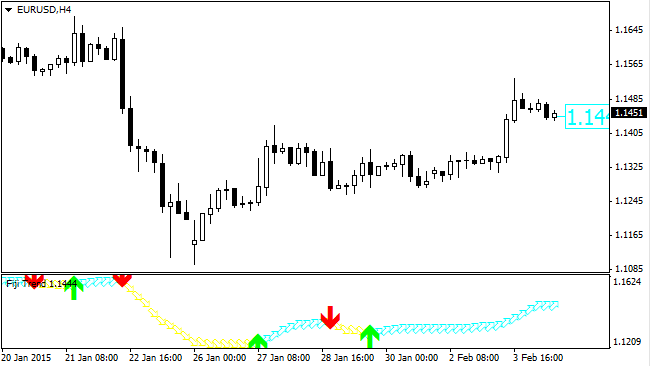

Unlike most of its peers, the Fiji Trend is not displayed on the chart, but rather in a separate window, and is therefore often called an oscillator. Just like many other signal indicators, this expert shall notify the trader about changing trends using the arrows (green emerged – a trend has changed to bullish, red – to bearish).

The current trend is also painted in special colors – a sequence of sloping arrows of the "water" color means that bears are now stronger than bulls, and a chain of yellow downward arrows indicates the predominance of sellers.

This expert uses in calculations such popular indicators as ATR and Moving Average, so both blocks of variables are available for adjustment in the settings window of the expert (one for setting the moving average, and the second for the ATR period). In addition, user can enable sound notification at the time the signal appears using a variable Sound.Alert, which becomes indispensable when trading on timeframes under H1.

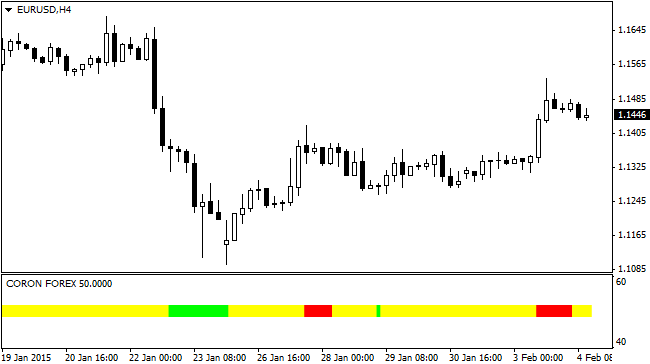

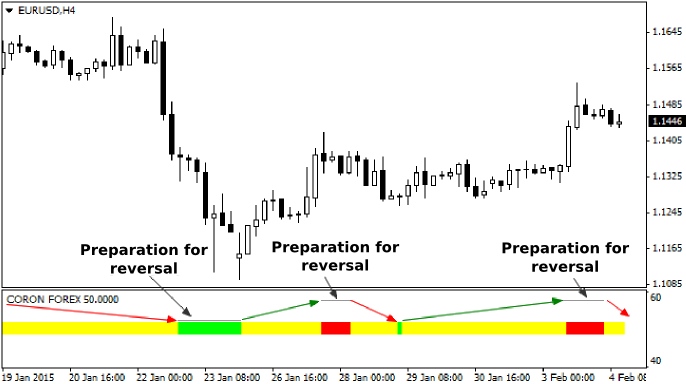

But the "arrows" are not the only signal indicators of the trend, the algorithms presented in the form of histograms are not less popular today. The indicator Coron Forex can be an example, which is both by appearance and approach similar to traffic lights.

As you can see, the indicator defines three states of the market, each of which is assigned a specific color, but you shouldn’t jump to conclusions about the approach, as Coron Forex signals are somewhat different from the usual “down-flat-up” sequence and are interpreted as follows:

- Red bars – the market accumulates power to reverse down. Sell after the yellow square replaces the red one;

- Green bars – the market accumulates power to reverse up. Buy after the yellow square replaces the green one;

- Yellow bars indicate the strength of the recent movement.

Unlike the Fiji Trend, it does not require adjustment, but it should be noted that it works best on large timeframes (H1 and above), but in the smaller periods, on the contrary, it generates a lot of false signals. On the other hand, the trend indicator should process the price on the larger timeframe, otherwise it loses its meaning and becomes an identifier for specific entry points.

What signal indicators you should choose to open orders

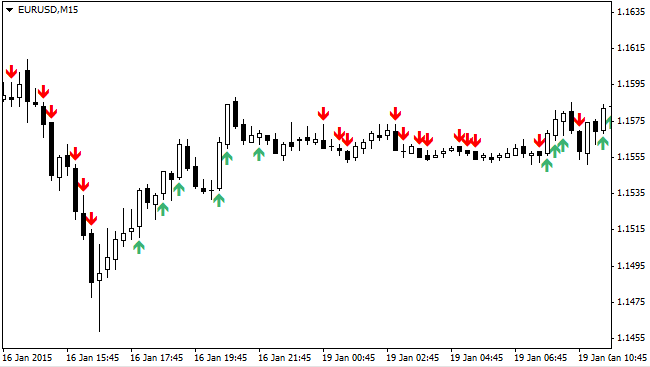

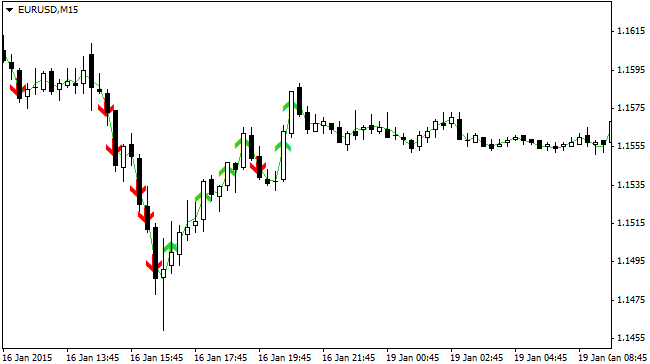

Once the predominant direction of movement was determined, the "classic" approach means you need to seek for more accurate signals to buy and sell, and if we continue the review, we can recommend A Hanafy5 indicator for use as an example.

Unfortunately, the developers disabled the ability to configure the parameters in your sole discretion, but, first, A Hanafy5 works well in a standard configuration, and secondly, you can always use the MetaEditor for the modification, as the indicator code is open sourced and freely available.

It is not hard to guess that you should open the order to buy when the green arrow appears, and concluding a deal to sell is recommended only after the red arrow pointing down appears. Signals themselves are formed on the basis of the values of RSI(14) and the Parabolic SAR, i.e. A Hanafy5 actually determines both the trend and the specific entry points, but it is better to combine its readings with other trending algorithms.

By the way, many of the signal indicators are similar to each other and find optimal entry points in the same position on the same levels – for example, an expert called showNticks forms its markups around the same points as A Hanafy5, despite the dramatic differences in code algorithms (showNticks is based not on the RSI, but on typical prices).

This is due to the fact that all the indicators and formulas are always based on price, so regardless of how it is processed, the results of the indicator analysis will be very similar. Of course, differences will also be shown from time to time, but more often they will be caused by the use of special filters, using which you can balance between the number of patterns and their reliability.

Some observations to be considered when choosing signal indicators

In today's selection, we specifically examined indicators without repainting, but he can’t help to recall that not all of these algorithms have such an important quality – on the contrary, many of the "arrows" remove their signals within a few candles after their appearance and "paint" the new ones. In part, that's why experienced traders negatively characterize signal indicators.

To avoid wasting time and money, it is always recommended to install indicators on the minute chart first, or use the Simple Forex Tester v2.0, which allows you to simulate the price movement. This approach allows to understand whether the expert repaints the markup in the first minutes of its operation.

The second negative issue faced by traders using the "arrows" is a lack of information about the formulas underlying the indicator. Even in some of today's examples, the settings section is closed, but the algorithm can be seen in the code.

If only .ex4 files and .ex5 (without .mq4 and .mq5) are available, it is not recommended to use such an indicator, because it simply makes no sense, as it won’t add knowledge and may even stop working after the next update of the terminal.

In conclusion, we should note that the signal indicators are most useful to those traders who for obvious reasons cannot monitor the situation on the market, because the sound notification built in almost all the algorithms of this class allows you to combine trading with other business.

Social button for Joomla