Trading within the range of volatility has always attracted traders, because most often simple tools are the most profitable. Super Signals Channel indicator is another version of the construction of the price channel, giving the signals of sufficiently high accuracy on any instruments and time periods.

The idea of working within the price channel is quite elaborated in different versions of famous Bollinger bands. In an attempt to give more practical application to the moment of the breakthrough by the price of the channel boundaries, the developers began to create options for indicators, which could be additionally used to build support/resistance levels, but not as a dynamic curve line, but rather as straight price levels.

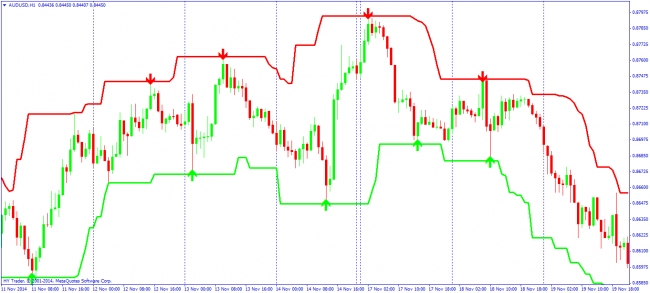

The Super Signals Channel indicator is easy to use, builds the real price channel from two lines (red is the upper limit, green is the bottom), in which the price moves. Method of trading is on the rebound from the channel boundaries. The recommended entry points into the long and short positions appearing in the dynamics are indicated by arrows of the corresponding color and direction. Conveniently, clearly and precisely. It works on any time intervals and any instruments, including futures and stocks. Optimal timeframe, like for all trend indicators, is from H1 and above.

Mathematics of the indicator

The Super Signals Channel indicator is based on the standard zigzag without any additional calculations, i.e. it builds its boundaries not by closing prices, like most indicators based on the Bollinger methodology, but by extreme values. The reversal signal appears when the price reaches new high/low on the specified number of candles. Apparently, the absolute value of the price (high/low) is taken into account, at which the level is built as a straight line. For comparison, let’s put a standard BB indicator and the proposed option on the same chart:

Offset or other additional parameters do not apply, i.e. the indicator assesses only the real dynamics and gives the minimum forecasts – it builds the continued price level until the next extreme.

Important: Unlike zigzag options, this indicator has no parameter that could make the channel wider/narrower.

Parameters and setting of the indicator

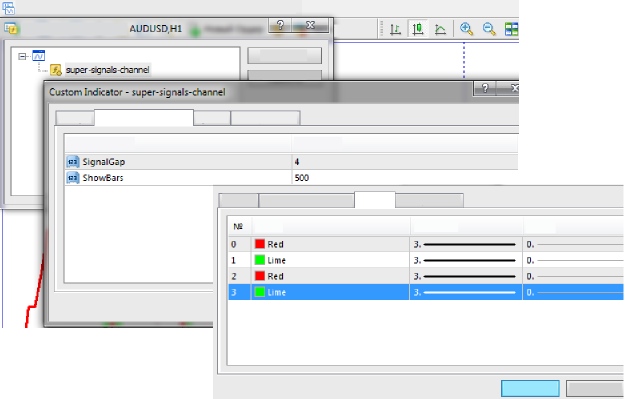

The indicator is installed in the normal way: copy the file of the indicator with the extension *. mq4. to \ProgramFiles\MetaTrader4\MQL4\indicators. In the shell of the terminal in the "Navigator" window, select "Custom indicators", search for Super Signals Channel and drag it to the price chart. The main parameters of the indicator:

SignalGap – determines the distance between the current price chart and signal arrows that indicate the recommended points to enter the market.

ShowBars – the number of bars used to calculate/display the channel, the default value is 500, you can set it bigger in order to cut the price noise and draw the price level further.

In some versions of the indicator, there is another option: repaint – on/off (true/false) mode of smoothing the channel lines.

Setting of the color scheme contains two settings for lines and signals (color and thickness).

Application of the Super Signals Channel indicator in trading

For Forex:

Two methods can be used. The first is that we completely trust the Super Signals Channel indicator: just follow the signal arrows – if it appeared, we open in a specified direction and close at the signal in the opposite direction.

The second, more profitable technique: do not pay attention to the arrows and trade depthward the channel, buying at the bottom (green) boundary and selling at the upper (red).

Important: trading on price levels of the indicator is much more reliable than by its signal arrows!

The Super Signals Channel indicator can be successfully used during the installation of stop-loss for transactions open by any other system. Stop for a buy can be set on the green line of the channel (below), for a sell – on the upper (just above). Someone may seem this stop as too big, because the price level of the indicator is a max/min of the calculation period, it can be quite far from the current price in the channel. However, this method of setting stop allows to hold transaction for a long time and to make the most profit from the trend movement.

In general, if we act wisely and carefully, it is possible to set the stops by the price levels of the channel 5-20 points above/below (depending on the period and duration of the transaction). It is even better to use the indicator with the ATP indicator versions – then you can enter the transactions by signal arrows for both short-term and intraday trading.

The Super Signals Channel indicator has proven itself to work with pending orders:

Buy – pending BuyStop is set 5-10 points above the bottom (green) channel line with a stop at 5-15 points below the channel line;

Sell – pending SellStop is set 5-10 points below the upper (red) channel line, stop is raised 5-10 points above the channel line.

You can try to use the indicator simultaneously on multiple timeframes – this greatly increases its accuracy. If an arrow for entry appears for all or at least several periods, you can securely open in the direction of the price movement.

The figure below is an example of an indicator in conjunction with the standard zigzag:

Important: when trading intraday with the indicator, setting stops is a must!

For binary options

The indicator builds the price levels fairly accurately, thus allowing to use it for work with options. Reliability of the signals given by the Super Signals Channel indicator is not reduced for different instruments or periods, as the channel is constructed on the basis of the current volatility – for short-term transactions, which are the options, that's enough. According to binary traders, this indicator is much more accurate than the popular Trend and HI-Lo indicators.

And as a conclusion

The only disadvantage, the most important and very serious one of this indicator, is that it eventually redraws. The greater the period, the less damage from the effect of redrawing and offset of the signal arrows. On the periods of up to 1 hour, the negative effect can be very strong, especially at the speculative volatility – there are a lot of false signals, and price levels often offset.

The Super Signals Channel indicator can be recommended for beginners to master techniques of the work on price levels. For more experienced players, the indicator can be easily integrated into any trend or combined trading system in combination with various oscillators and volume indicators. It is a volume indicator that will help separate the real reversal points within the channel from speculative shots. Also, the indicator can be used as a filter for the signals received from the other indicators

Social button for Joomla