Many traders want to build a trading strategy based solely on computer displays. This is primarily due to the fact that browsing history, old quotes and charts for past periods, the trader sees a near-perfect operation of all the signals that are received from the selected indicators. So be it, but why, then, in practice, the indicator and strategy advisors bring over most of the losses and eventually drained deposit? In this article, we will determine what assistance can provide indicators of the trader how to properly use them and select the best forex indicators for certain situations.

To use the indicators to understand their nature, characteristics and principles on which they are built. Let's start with a definition of the term "indicator". So, forex indicator - a tool for the analysis, which is based on an algorithm of constructing and converting market data. It should be made a very important point, first appearing prices, quotas, and the data indicator after. In fact, this is their main disadvantage is why trade, relying only on the indicators didn't.

Now we will look at what indicators are and when to use a specific type of indicator. To start distinguish three main groups of indicators:

- Indicators of trend;

- Oscillators;

- Volume indicators.

In the order, the indicators show a trend trader to determine in which direction the market is going - up, down or sideways movement in the market. As you can imagine, this type of indicators can give a clear signal to buy or sell, the trader is based on the indicator data will determine the direction of the trend and accordingly tries to trade with the trend. The best forex indicators to determine the trend - Moving Average, ADX.

Moving Average (MA) - if the price is above the MA, it means that the market upward movement, on the contrary - downward. When the price chart and the MA line overlap can be stated that there is lateral movement. An important parameter is the period Moving Average, standard he is 14, but some traders use 50, 100 and 200 day moving averages. The longer the period, the more accurate, but at the same time and more globally can determine the direction of the trend.

ADX (Average Directional Index) - shows the strength of the current trend. The larger the value zero, the stronger trend. Note that the indicator does not indicate the direction of the trend, it has to determine the trader directly. It's not that hard, you just have to look at the price chart, if the value of the indicator, for example greater than 20 on the chart and an increase in prices that the trend is up.

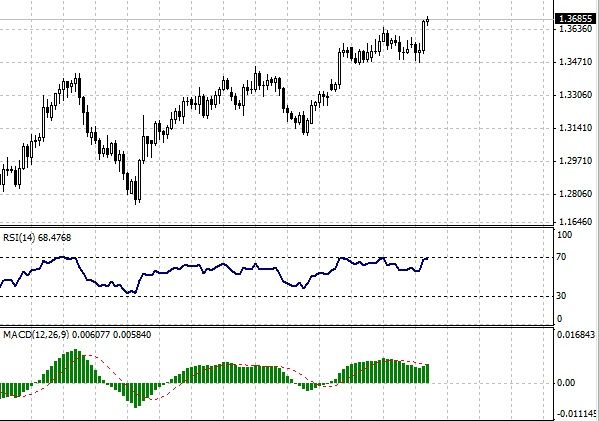

The next on our list a group of indicators called oscillators. These indicators are used by traders in times of lateral movement, with indicators trending movement of the oscillator does not cause much interest. The best forex indicators of oscillators - RSI and MACD.

RSI (Relative Strength Index) - this oscillator is probably the most popular. It shows overbought and oversold market. Trader needs to look at the display, the intersection of level 70 or 30 indicates a possible reversal in prices. As we mentioned earlier it is best to use the RSI at the time of lateral movement, if the market is a strong trend, the indicator may be a long time in one of two states.

MACD (Moving Average Convergence/Divergence) - this indicator differs from the standard oscillator. First, it may indicate the direction of the trend, if the histogram indicator is above zero then the trend is upward, downward below zero. Second, it allows us to find instances of divergence and convergence, in simple words it's the power of matching the price of the market. More details about the analysis using MACD we will write soon.

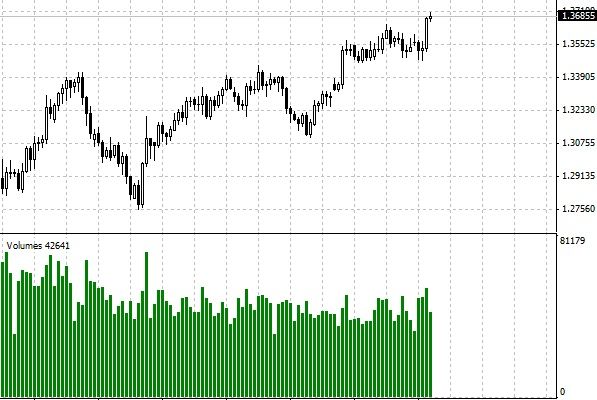

Finally, the last group of indicators - indicators of volume. Their main function is to inform the trader of activity in the market. So, for example vertical volume allows to determine the levels at which the activity was increased, that is, the price may meet resistance or support around him. Unfortunately, the best forex indicators on the volume available in the MetaTrader 4, so that traders use a third-party indicators that can be found in the vast network or to other platforms.

Using the LEDs can greatly facilitate trade important to remember that the signals from these are optional and can not be selected as the basis for the opening position. Also, in many situations, there are your best forex indicators that best help the trader to decide on further action. Good luck trading!

Social button for Joomla