The wave indicators are the supporting analytical instruments, which principle of work is based on the Elliott Wave Theory. The Wave Theory is a rather unified theory, which examines the dynamics in exchange prices. Like any other applied discipline of technical analysis, the Elliott Wave Theory is based on the principle of finding a certain graphical patterns that can predict trends. Axiomatic apparatus of this theory comprises the original and logical assumptions on the behavior of the crowd.

The wave indicators are the supporting analytical instruments, which principle of work is based on the Elliott Wave Theory. The Wave Theory is a rather unified theory, which examines the dynamics in exchange prices. Like any other applied discipline of technical analysis, the Elliott Wave Theory is based on the principle of finding a certain graphical patterns that can predict trends. Axiomatic apparatus of this theory comprises the original and logical assumptions on the behavior of the crowd.

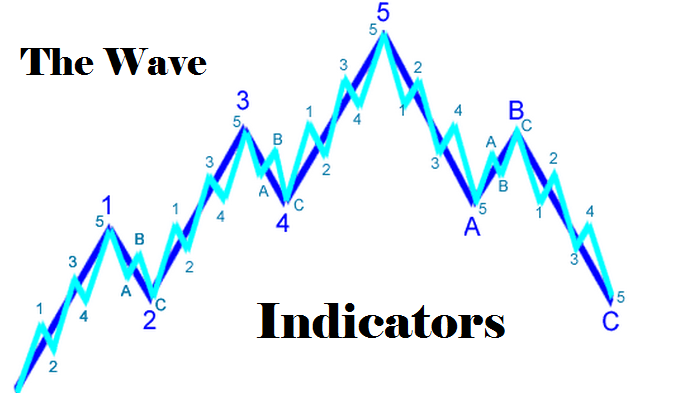

This article describes indicators that are used by the wave theory adherents. In order to understand the way of wave indicators work, you must have some idea about the principles of theory itself. Under the wave theory, there are eight waves, which comprise a sequence of cycles. Such cycles can be met constantly on the graphs. The waves’ proportions are estimated be the numbers of the Fibonacci sequence. The traders’ aim is to find and recognize waves and make a market forecast on this basis.

There are only two kinds of waves: impulse and correction waves. Usually major market movements occur within an impulse wave. Impulse waves are the movements in the trend direction. The corrective waves - are countertrend movements. The main profit traders get in impulse waves.

We are not going to study the theory of waves deeply in this article, later we will provide the separate article for this topic. Here it should be mentioned that the trader, who is going to use the trade indicators which are based on the Elliott's theory, must know the theory as well. It means the trader should be able to distinguish different waves. And wave indicators allow traders to filter and classify waves of different order and level.

The wave indicator Elliott Wave Prophet

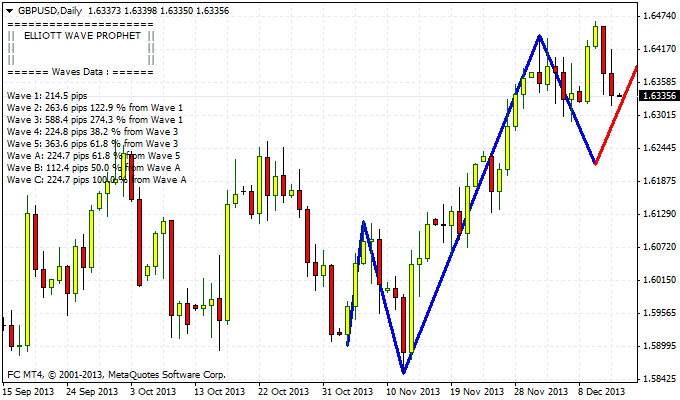

In practice, traders who apply wave analysis, face with several problems. The main difficulty here is to determine the wave cycles and structures. In order to facilitate the trader or wave analyst task a special indicator that is the Elliott Wave Prophet was developed (see picture). On the one hand you should not overestimate the ability of such instruments. But on the other hand, the wave indicators can be very useful in certain stages of the analysis.

The Elliott Wave Prophet indicator shows waves which were already formed on the chart. However, this indicator has other functions as well. This indicator is also able to indicate some guidelines for potential motions. This matter concerns both impulse and corrective waves. The Elliott Wave Prophet indicator can identify a specific wave cycle and dive a signal of the key levels.

To install the Elliott Wave Prophet you should download an indicator file into a folder .. / experts / indicators, then run the MT4 terminal. After that, select the chart and in the menu "Insert" - "Indicators" - "User" select this indicator. When the Elliott Wave Prophet is selected the settings window will appear. You can adjust some settings in this window. DrawFirstLines is the number of first waves that will be built by the indicator. You can find the color settings of formed and projected waves here as well.

If for some reasons you are not satisfied with the wave automatic construction by Elliott Wave Prophet, then you can always set the initial settings by your own. To do this, you simply need to drag the waves one after another to those graph areas where you see a clear structure. After that the indicator will automatically generate a potential scenario.

Wave analysis can be conducted in various ways. One possible option is: the trader makes his visual estimation of the wave structure first, and then uses the wave indicators to compare them. Thus, regardless of the skills and experience of the wave analyst the waves’ indicators will help traders greatly in providing of the market dynamics analysis.