A person unfamiliar with the world of currency speculation can’t imagine trading without the use of complex indicators. He or she believes that the complex analytical tools ensure profitability of trading. In fact, the situation is somewhat different.

Many professional traders either don’t use indicators in trading at all, relying mainly on the technical or wave analysis, or use them as an auxiliary tool. But in this case simple Forex indicators are normally used.

Opponents and supporters of the indicator trading bring forward strong arguments for their position, but the only thing is for sure: indicators can actually bring many benefits to trading. However, this has nothing to do with the complexity of its algorithm, as the right choice of indicators and their settings plays the crucial role.

MA can be mentioned as an example of the effectiveness of simple indicators. Despite the fact that they refer to the simplest Forex indicators, moving averages are still popular. Even operating trading systems are created based on them.

Popular simple Forex indicators

The concept of “simplicity” of the indicator is rather arbitrary. If the price chart is not cluttered with many lines, it does not mean that the algorithm of the indicator is simple. It only means that this indicator is useful. One can judge the complexity or simplicity of any analytical tool only being aware of its algorithm, but there are no clear criteria of simplicity and complexity in this case either.

In each group of the indicators, there are some of the most common. So, moving averages stand out in the group of the trend indicators. They can be called the simplest of all possible indicators – the line is built by averaging the prices. Despite this, the moving averages are the basis of many profitable strategies. Bollinger Bands, Parabolic SAR, and several other indicators are also quite popular.

Stochastic, RSI, MACD, and CCI are worth mentioning in the group of oscillators. They perform well at the flat sections of the market when the price for a long time is moving in a horizontal channel. The divergence on any of the indicators is also a pretty strong trading signal.

As for the volume indicators, it is difficult to give preference to any one instrument. Volumes indicator, Money Flow Index and others can be used equally well. Their main purpose is to give an overview of the processes in the market.

Simple Forex indicators: criteria of “simplicity”

Speaking about the simplicity of the indicator, the trader primarily has the ease of its use in everyday trading in mind, i.e. how clearly it provides information. As for the complexity of the algorithm, it is not considered at all.

This is exemplified by virtually any arrow indicator. Any such indicator only draws arrows on the chart – signals to go short or long. At the same time, for example, the Ichimoku trend indicator draws several lines on the chart and shades the area of the cloud. It looks much more solid than simple arrows on the chart.

As a result, the trader may have an impression that the arrow indicator analyzes the situation in the market superficially, while Ichimoku indicator gives a more complete picture of the current situation. However, in reality some arrow indicators are far superior to the Ichimoku indicator by the complexity of the algorithm.

This suggests that you must reject the superficial judgments. At first glance, simple Forex indicators can actually be powerful analytical tools. And the apparent simplicity is just a consequence of the convenience of this indicator in operation, which can also be assigned to its advantages.

How to start earning with simple Forex indicators?

You can create a profitable trading system based on the simplest indicators. You can also use them as a supplement to the technical or wave analysis. To create a working trading system, you must adhere to the following rules:

- it is recommended to use no more than 3-4 indicators at a time;

- it is better to exclude volume indicators from the trading system;

- don’t chase the impressive appearance of indicators, it is better to give preference to proven tools;

- set of indicators should allow the system remain lucrative both during the trend and the horizontal motion.

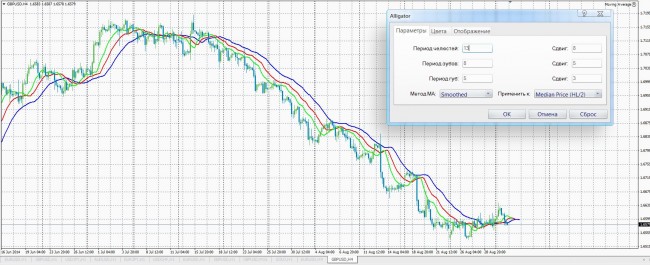

From trend indicators, the set of MA is most commonly used. With the right choice of parameters, moving averages will identify emerging trends in the very beginning. The example of the effectiveness of this tool can be Alligator indicator by Bill Williams (based on the MA).

From oscillators, Stochastic, RSI, MACD, and CCI can be emphasized, as other indicators from the standard set are used far less frequently. For example, Stochastic can be used in order not to miss the end of the correction or for trading from the boundaries of the horizontal channel.

Examples of commercial systems based on simple indicators

Simple Forex indicators can actually make a profit. This is exemplified by a number of strategies that are based solely on the moving averages. For example, the EMA96 strategy belogs to the trend group, using only the moving average with a period of 96.

According to the rules of the strategy, to open long positions you need to have the previous day’s price above the EMA without even touching it during the day. The next day the deal is made at 8am GMT. The conditions are opposite for a deal to sell. It is recommended to split the entire deal into 3 parts:

- 1/3 of the standard volume – with TP 50 points and SL 50 points

- 1/3 of the standard volume – with TP 100 points and SL 50 points

- 1/3 of the standard volume – without TP and the same SL

Thus, simple indicators can be recommended for most traders. Visual simplicity does not mean that the selected indicator analyzes the market superficially. As a rule, no additional information is displayed in order not to confuse the trader. Of course, lucrative trading with their use is possible only if adhering to the rules of the trading system.

Social button for Joomla