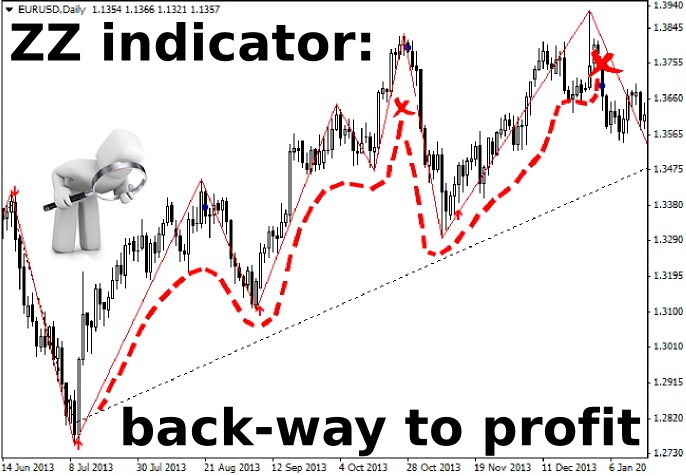

The main goal of any trading strategy is not even searching for a particular signal to open a position, but rather filtering out the excess market noise that can "break" reliable patterns, and ZZ indicator is very good at handling this task.

By the way, this abbreviation is quite rare, although almost every novice trader is familiar with the family of these indicators thanks to the famous ZigZag, which is included in the standard package of almost all trading terminals: in fact, today we will talk about a "zigzag", as well as some of its modifications.

How does ZZ indicator work?

If you look at the chart, ZigZag can be described as follows: it is a broken line (in other words – the curve) connecting the price extremes. It’s that simple, this indicator does not give any signals, does not predict trend reversals, it just processes historical data and connects the last two lows and highs with a line.

Of course, in order to enable the expert to filter out the noise and avoid connecting a low and high of two neighboring candles, special variables were added to the formula: for example, when trying to set a standard ZZ indicator to a chart, a setting window will appear with the following options:

- Depth is a minimum distance in bars, where the indicator will not paint a new extreme if it deviated from the previous value by the Deviation value;

- Deviation is the minimum number of points that the price must pass from the previous extreme before ZigZag identifies a new extreme (expressed as a percentage);

- Backstep is the minimum number of bars between extremes.

Thus, the ZZ indicator will always lag a bit and even occasionally repaint the last low (high), i.e. it will first mark it, and after the new market pulse breaks through the extreme, it will remove the old markup. Accordingly, the larger periods the user sets in the settings, the lower the probability of repainting, but the reaction rate of the indicator also begins to fall.

ZZ indicator in trading strategies

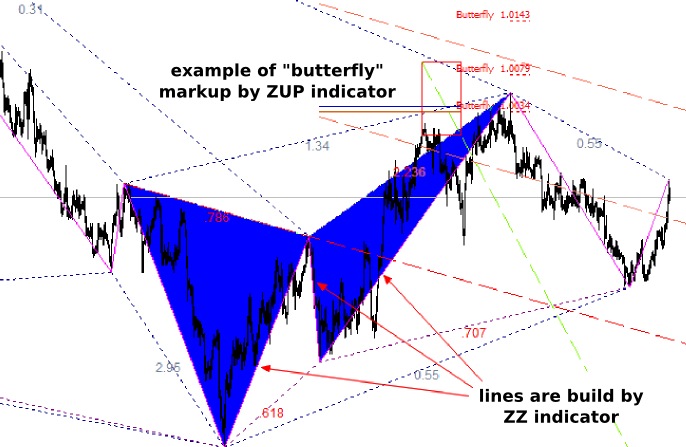

As already noted, these indicators filter noise well, so they can be successfully used in virtually any medium-term trading system, for which a slight delay of signals is not critical. By the way, the first practical example of working with zigzag that immediately comes to mind is building the Gartley butterflies.

The figure above shows the markup by ZUP indicator. If earlier you had to manually build all the tangents and rays for identification, now MT4 users can assign this job to a special algorithm for which the ZZ indicator became the basic formula.

In addition, you should not forget about the Elliott Wave Theory. Remember that the wave analysis suggested by Ralph Elliott assumes that the behavior of the crowd in the financial market can be described by the wave structure. Ralph first mentioned his observations in the 30s of the 20th century, but since then little has changed to the present day, as the main drawback of the wave theory is still subjectivity of a trader who builds the markup.

The ZZ indicator also helped solve these problems, as it impartially represents the kinks on the chart, thus allowing to identify the beginning and end of the wave on time. In recent years, there were even special expert advisors working on the Elliott’s theory.

As for the other trading strategies using ZigZag as a filter, their description can be endless, because today there are hundreds of them out there, and this list is constantly updated with new ideas. One thing to note is that this indicator shows the best results in conjunction with moving averages and any levels (when trading on the rebound).

Which custom ZZ indicator can be useful?

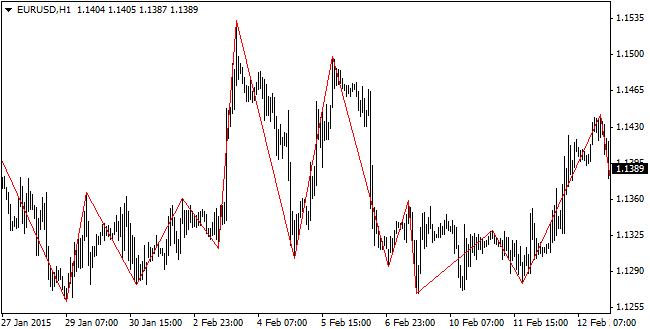

Continuing on the topic of levels, we should note that a good solution is the ZigZag modification designed to mark the support/resistance levels. This algorithm can be found under the name ZZ SR TL online, and looks as follows on the price chart:

As you might guess, the ZZ SR TL indicator builds levels through each extreme. Despite the seeming futility of such an operation, it has an important function – it saves time, because in the case of improper shutdown of the terminal or accidental closing of the chart the markup will be gone, and it will be much easier to restore it using the indicator than to build it again manually.

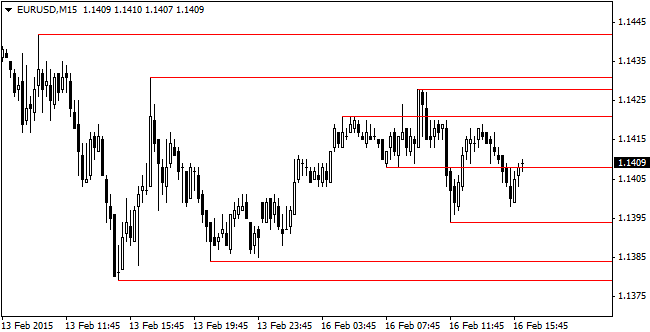

Another interesting expert is called ZigAndZag, whose developers still tried to create a "zigzag" trading strategy without the use of additional criteria and methods, adding signals to open and close positions to ZigZag.

Trading algorithm with the said indicator is extremely simple – if an up arrow appeared, we buy, and if a down arrow appeared, we sell. Profit and loss are fixed at the appearance of a small colored circle. Expert customization is also elementary and is reduced to optimization of only two parameters:

- KeelOver – the lower this value, the less minor noise fluctuations influence the result, i.e. instead of setting all three parameters (as in the original version), the trader sets only one value;

- Slalom – criterion is responsible for the frequency of the signal appearance: the higher it is, the fewer arrows will appear (only the most reliable patterns will be left).

Strengths and weaknesses of zigzag indicators

Summarizing the results of a small survey of today, we should say a few words about the shortcomings inherent in such algorithms, and the first thing we should pay attention to is delay, so the ZZ indicator can’t be used in scalping strategies as part of the signal, the only area where it can be useful in this case is search for pulses.

Another drawback is associated with the very building algorithm. Earlier this was almost never mentioned, but today Renko charts built in the “Price-bar No." coordinate system are more effective method of noise control, and the delay in this case is much lower than in the construction of a zigzag that uses the "price -time" terms.

On the other hand, the indicator considered today is very simple to use, because while you will have to install special expert advisors or indicators for the construction of the Renko charts in MT4 and then open a separate stand-alone window with a unique timeframe, the ZZ indicator is already included in the standard package of the terminal and ready to go.

Social button for Joomla