Analytical review of EUR/USD with a forecast for Wednesday, June 5 of 2013

Yesterday American currency was trading slightly better than euro. However, the trading session closed with euro growth by 8 points, despite entering side movement and volatility of the market by 62 points.

Fundamental analysis:

Yesterday it became clear that that prices of manufacturers from Eurozone dropped once more and turned out to be 0.6% - PPI. News from across the ocean isn’t great either. The shortage of foreign trade of goods and service according to US Department of Commerce grew by 8.5 % to 40.3 billion dollars, in the previous month they happened to be 37.1 billion. The import exceeded the export: 5.4 billion against 2.2 billion.

ICSC and Goldman Sachs published sale index in retail chains of the US, within a week they grew by 1.9 %. In the future according to ICSC the growth of these indicators to 3 % is expected.

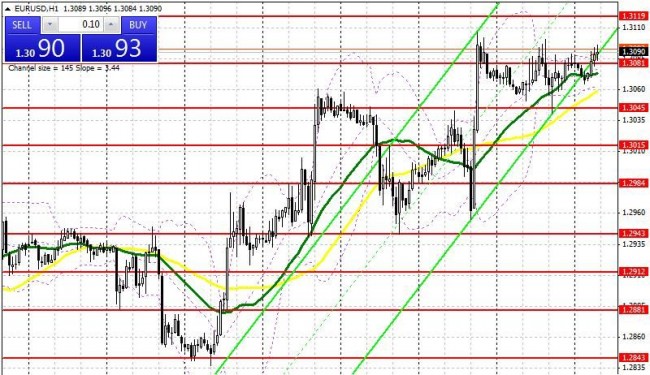

If we analyze the technical situation of currency pair, we can say that despite all the attempts of bears to take over the market, euro is still at a positive side of the market. The trading is carried out between the levels of 1.2955 and 1.3041.

Now we are watching closely the development of the pair above the level of 1.3081. The following growth is considered up to 1.3119, further 1.3141 and 1.3165. Which is supported by gliding averages of 30- and 50-daily.

The deployment of the market is considered from the level of support 1.3081 to 1.3045. Such scenario is possible with weak expectations of Eurozone. The lowest value in this situation are 1.3015 and 1.2984.

Bollinger Bands indicator is still directed upwards, however, its lines were on time to narrow. The main support within the indicator is the level of 1.3976.

The indicator of MACD is pointing at upcoming correction, its bounds are approaching a zero point.

On the whole all the rates are directed at bulls. If they are capable of keeping euro higher than 1.3119, it means that a steady growth is possible. The main levels of support are: 1.3081, 1.3045, 1.3015 and resistance: 1.3119, 1.3141, 1.3165.

The main levels of support and resistance of the pair GBP/USD for Wednesday, June 5 2013

Yesterday pound sterling was capable of passing dollar with good news about the activeness in the building area of Britain – index of managers of supply PMI for construction sector was 50.8 points, compared to April with 49.4 points. Basically, the pair was trading at the level of 1.5284 and 1.5318.

Today we are expecting the bulls to cross the resistance 1.5339, which will lead to growth of the pair to 1.5367, further 1.5392 and 1.5431.

The deployment of the market is not excluded after the rate passed the level of 1.5294, further 1.5281 and 1.5261. Minimal level is considered at a rate 1.5236.

Social button for Joomla