At yesterday's auction at the end of the U.S. trading session, the chairman of the Federal Reserve signaled to the market that the possible start reducing stimulus measures - this is not the tightening of monetary policy. Thus hinted that the time of cheap money has not yet passed. According to some experts, Bernanke is trying to show that the decline in QE3 will not result in a reduction in the balance. And, do not jump the gun, as long as the labor market is still quite weak, and inflation rates are low, and that's all, in turn, suggests that reducing the volume of bond purchases at this time early. Thus, Ben Bernanke said that as long as until the cogent arguments supporting a significant improvement in the economic situation, the FED intends to continue to pursue accommodative monetary policy.

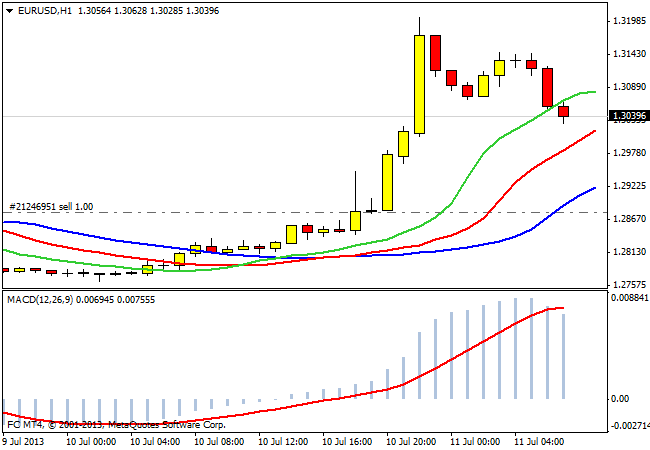

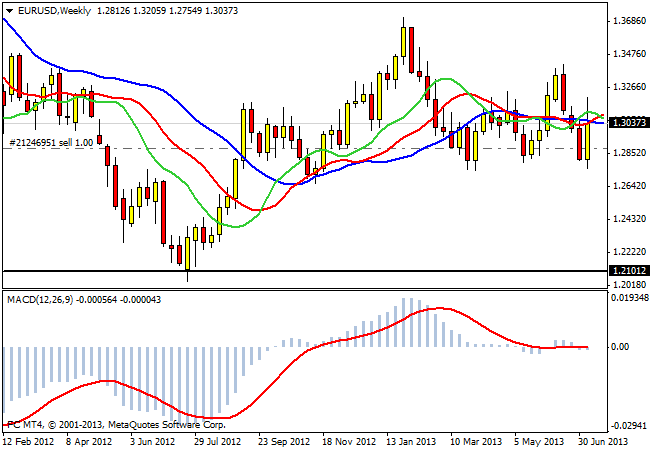

EUR/USD moved north after finished his speech from FED Chairman. The upward movement stopped only at the level of 1.32 . The reason for this sharp rise of the euro could be a total closure of short positions. Perhaps speculators overestimated the FED's willingness to act in September. Now a pair of quotes rolled back a bit and are at the level 1.3050 . According to dealers, the volumes have grown significantly, and, most of all, the demand for the euro will continue until the end of the week. In such moments of emotional movements should not jump to conclusions and interpretations of the situation. Medium-and short-term picture has undergone major changes, but the long-term picture remains the same.

Key levels - is still 1.34 and 1.27 . Once the quotes couples leave this range, we have a chance to see a powerful movement with the right medium to develop into a long-term trend. How long will the current upward momentum - hard to judge. It depends on the extent to which market participants pledged swift tightening of monetary policy by the FED. In any case, players who are betting on the dollar, it makes sense to wait.

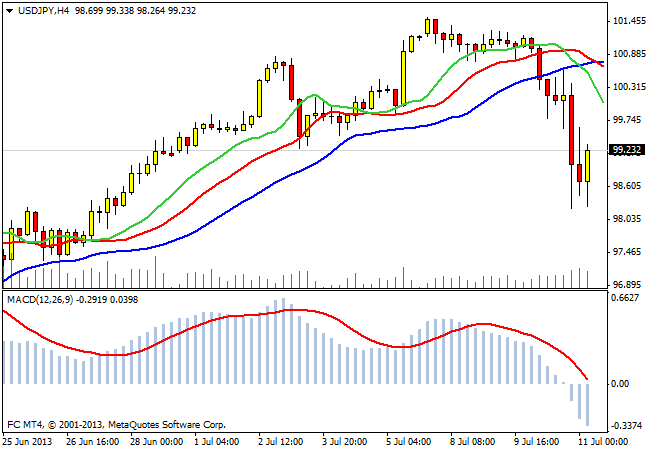

In the currency pair USD/JPY in recent days, there is a decrease. All the attention of the players in this market was focused on the publication of statements of the Bank of Japan. As it became known, the Bank will continue to perform operations on the money market. The main purpose of this activity is to increase the monetary base. There have also been voiced by a number of conditions to purchase assets. It is worth noting that the Bank of Japan intends to continue to continue the policy easing, which aims to achieve the inflation rate of 2 %.

Quotes USD/JPY during the bearish momentum reached the level of 98 yen to the dollar, and then renewed demand for the dollar. At the beginning of the European trading session, the pair is trading at 99.30 . Strong dives in USD/JPY will likely not be so any dollar sale here can be used to continue the medium and long games on lowering the yen.

Good luck trading!

Social button for Joomla