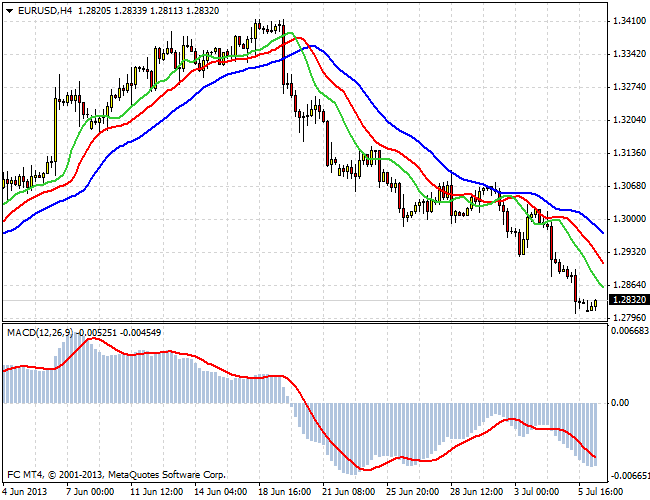

The previous trading week for currency markets was somewhat critical. Central banks have decided on the course of monetary policy. The Fed has made it clear that it intends to begin curtailing stimulus measures already in September, if the labor market will continue to show strength. The ECB and the Bank of England, by contrast, have expressed readiness for further easing. EUR/USD was under pressure all week and showed a decline in area of 1.28 .

News background on this pair all week was a good basis for the game on the decline. Developing political crisis in Portugal led to a sell-off in the euro early in the week. Then the head of the ECB Mario Draghi finally convinced markets that monetary policy will continue to remain soft, and that if necessary, a transition to negative interest rates. At the end of the week we saw the publication of statistics on the U.S. labor market, the data were not strong enough, which, in turn, only strengthened the faith of investors in the speedy completion of the program QE3. Here's a clip from the news here in favor of the dollar has led quotation EUR/USD to a level of 1.28, for which the pair continues to trade in the moment.

1.28 - 1.27 zone - a zone of support. It is at these levels, renewed demand for the euro in May. Perhaps this is a key area for the long-term prospects for the European currency. Of course, short-term or medium-term bullish on the pair of pulses likely, but given the fundamental factors, long-term forecasts still in favor of the dollar.

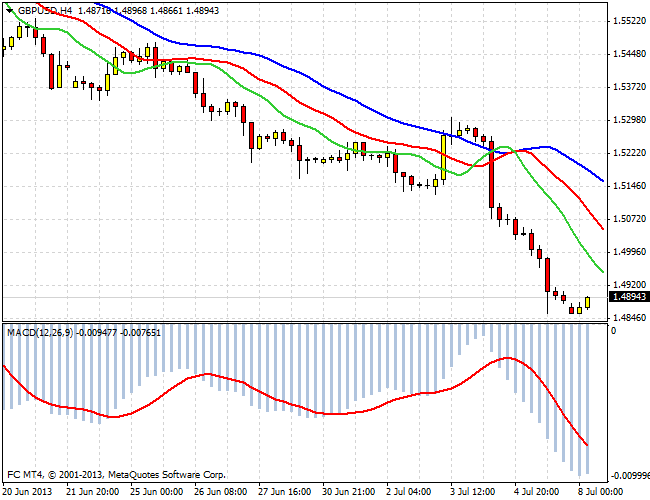

GBP/USD also finished the week at the lows. Having established a local maximum at 1.53, the pair swiftly plunged under support 1.5130 and is now trading around 1.49 . 1.48 - 1.49 levels - is the most powerful support. With these levels pound began to strengthen in February of this year. Quickly and easily pass the area is unlikely to succeed, as market participants prefer to take profits and close short positions. In the formation of topping signals, the short-term it makes sense to look for opportunities to improve tactical play in this pair.

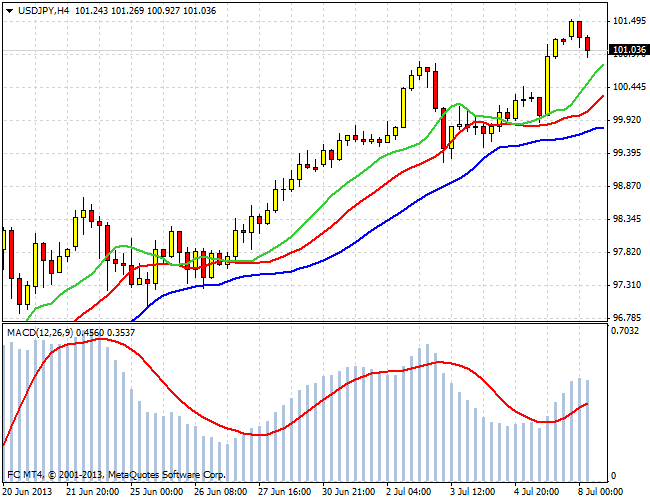

In USD/JPY is still volatile, and the past week was no exception. Bullish trend is inexorably evolving day by day. At the moment, we see that the pair of quotes almost reached yearly highs. There also may be some profit-taking. In this regard, market participants who set up speculatively, it is recommended to reduce their long positions.

Good luck trading!

Social button for Joomla