U.S. dollar slightly losing ground against its major competitors in the absence of significant macroeconomic data. The company regularly conducts Bloomberg survey of economists to determine the expectations regarding monetary policy the FED. Recent survey data indicate that experts are more likely to believe in the FED's willingness to act in September. So say about 50 % of the respondents surveyed Bloomberg. Their point of view, some experts based on the fact that the markets, in their opinion, has the potential to adapt to changes in the policy of the FED, and now tightening does not carry the risk of high volatility. In a sense, the representatives of the monetary authorities would be prepared as markets for end of stroke easing. The second half of the respondents believe that the FED will act only in the second quarter of next year.

The European single currency grew slightly against the dollar on Monday trading. No fundamental factors for confident purchases euro is not visible, but the technical picture still contributes to the development of demand. Lots of yesterday's trading session - 1.3217 . The pair makes attempts to get closer again to this level. Such a moderate bullish momentum is likely to continue for several days. Tomorrow published important data on the economy of the Eurozone, so we can safely assume that the current trading session will be held in a peaceful manner. Technical barriers for couples to 1.34 no more. In this regard, many speculators may want to play on a short-term increase in the euro. According to dealers in the area of 1.34 is a lot of sell orders. Thus, it's possible to play on the rebound when testing 1.34 mark.

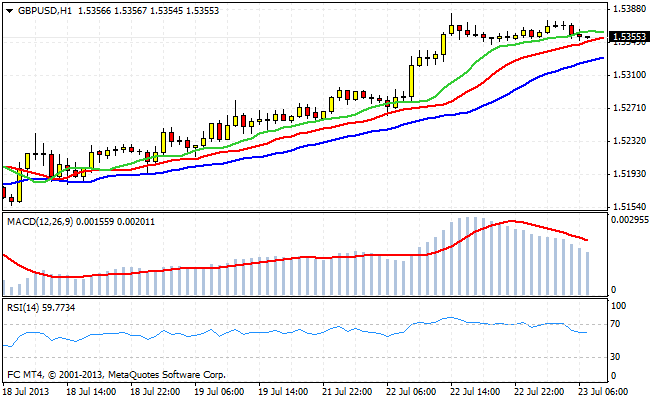

Sure enough growth demonstrates the pair GBP/USD. On Monday a pair peaked at 1.5383 and continues to consolidate close to the mark. The reason for this positive attitude of players for the pound may be waiting a good report on UK GDP for the second quarter, the publication of which is scheduled for Thursday. As participants of the market, the data on the growth of the economy, may pleasantly surprise investors, so the market is trying to pre-empt it in the prices. Consequently, on strong GDP data, we can expect some correction in a pair of quotes. The nearest significant resistance level for the pound - is marked 1.57 . Thus, the bulls in the GBP/USD pair is room for play in the 3.5 dollar figures.

Good luck trading!

Social button for Joomla