Within several trading sessions just before the FOMC meeting dollar yielded its positions. According to experts such weakening of American currency has a quite aggressive nature. Currently markets are not active, they expect news about QE3. Opinions of market participants in reference to correction of monetary policy are different. Some people think that such measure as decrease of QE program is forced and that excessive liquidity does not promote normal rehabilitation and economy development. Others on the contrary are confident that solution of monetary authorities about decreasing program on stimulating economy will only confirm the fact that the economy has been restored and can continue to grow without any support. In general, toughening monetary politics will provoke lack of appetite of market participants towards risky assets and will encourage increased demands for assets that re in dollars. Otherwise, we will become witnesses of another wave of US currency weakening.

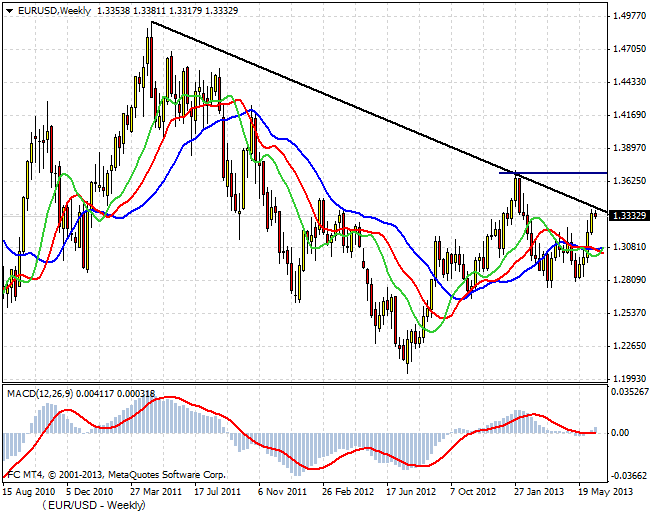

Chances for continuing medium-term ascending impulse in EUR/USD are still high. But nevertheless one should be ready for the situation to change abruptly and we will see significant consolidation of dollar. At the moment the pair is trading near the line of resistance, which links maximums of 2011 and 2013. In case of overcoming this resistance the nearest aim will be the level of 1,3700. And if FRS statements provoke a wave of dollar growth, then there will be a possibility to open short positions on the pair with the aim of 1.28, putting stops slightly higher than June maximum.

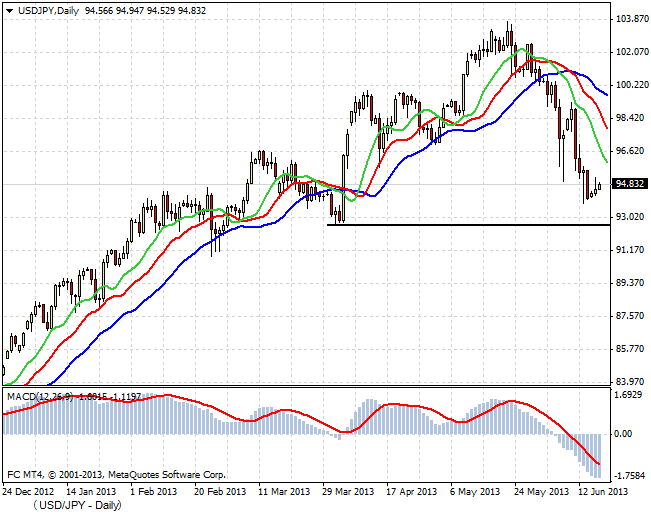

The situation with currency USD/JPY pair is developing with the most predictable scenario. The pair is trading not far from powerful level of support – 92.60. In case of volatility an attempt may be made to test this level and to derangement of stop-orders. However, in short-term plans we will possibly see continuation of growth of dollar against Japanese yen. Consequently all the descending impulses can be viewed as comfortable opportunities to occupy long positions on dollar.

Until the end of committee meeting connected with open markets one should not expect significant movements neither on currency nor on stock market. Investors will prefer waiting for specific statements from monetary authorities.

Social button for Joomla