Current news background isn't able to cause any significant change quotes on major currency pairs in the market FOREX. The head of the Federal Reserve Banks continue to take turns to express their views on the current situation in the U.S. economy and a bit pampered analysts forecasts.

According to Jeffrey Lacker, occupying the post of Reserve Bank of Richmond, in the future, the U.S. economy will continue to grow at the same rate, what she progressed in this. Thus, the basic outlook - this is an increase of 2 %. Compelling reason to re-evaluate this projection isn't.

It should be noted that Lacker isn't a supporter of the current loose monetary policy. In his view, the effect of maintaining the volume of redemption of bonds at 85 billion dollars to the economy is very doubtful. John Williams, Lacker colleague from San Francisco, says that the trend of recent months suggest that U.S. economic growth falls short of expectations. At the same time dissolve and hopes that the labor market will be able to somehow recover without monetary stimulus. Most recently, Williams was more optimistic in their forecasts, but now revised his views, because, according to him, the real growth of the economy is happening.

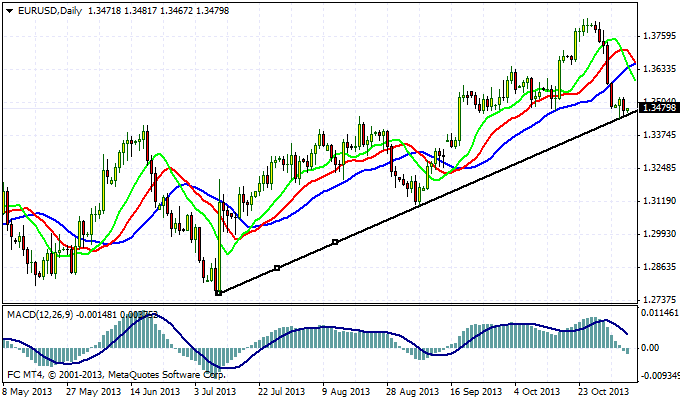

The EUR/USD is trading at 1.3495 at the end of the Asian trading session. Trading activity on Tuesday was at a low level. Players prefer to take a passive wait and see attitude. If you look at the euro medium-term chart, you can see virtually jewelry testing uptrend support line that originates in July of this year. Apparently, this is a key milestone, the resolution of which will open the way bears.

While the quotes of the single European currency isn't in a hurry to go down. Seems logical scenario to trade above the support level near followed by breaks. Now short-term upside risks in the pair are in the area of 1.3570 and 1.3600 . Once the euro will show willingness to continue to decline and this is confirmed volumes, you can again take short positions and increase their level of 1.3440 at pass.

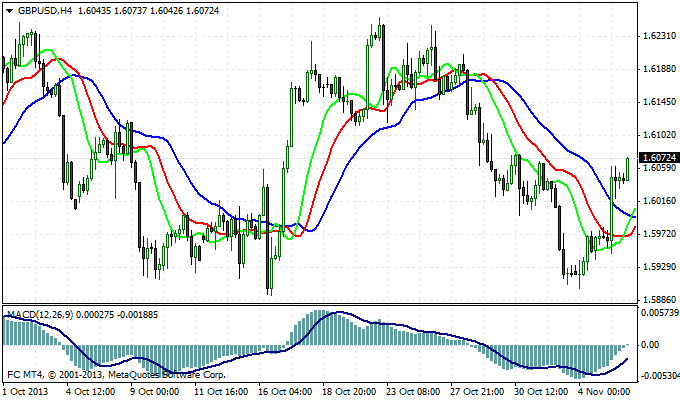

Yesterday, the European Commission has updated forecast for the UK economy. According to experts of the institution, growing domestic demand has provided substantial support to economic growth, along with exports. GDP growth of 1.3 % this, and by 2.2 % next year - that's such a purpose the European Commission said.

Quotes pound at the moment are at the level of 1.6080 . Testing the lower limit of the medium-term channel showed that the bulls on the cable does not intend to give up so quickly. Given this, you can search for short-term speculative opportunities the game to improve the British currency. The aim here at the top may be a resistance level at 1.6250 . In this zone is likely quotes pound again be pressurized sellers as there extends also a long-term resistance.

Good luck trading!

Social button for Joomla