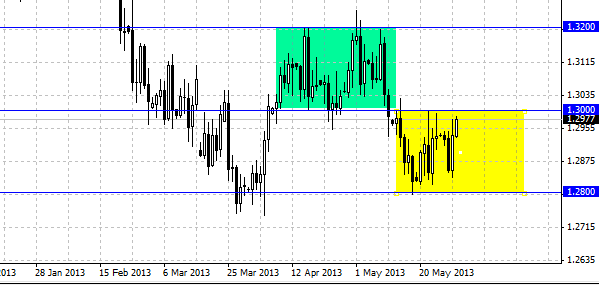

How long will the level of 1.30 stay?

EUR/USD pair made a strong movement on Wednesday, despite not as very positive economic data from Europe, the pair is approaching the mark of 1.30, which will restrain the growth of euro, while the level o 1.28 at the base of the block acts as a support. As it was stated earlier traders are trapped within these levels, and until they are not broken the market will stay profitable only for short-term deals.

We also assume that the level of 1.30 is a middle part of a bigger area of consolidation for EUR/USD pair. It may be assumed that now we are in a lower part of a bigger area of consolidation. Even the movement of the pair higher that the level of 1.30 wouldn’t mean that the market is ready for a big movement upwards and the period of bulls is over. In case of a breakthrough of the level of 1.30 the market will continue to drift in the corridor of 1.30-1.32 and move just like the previous days. After all it describes significantly the whole month of April for the EUR/USD pair.

Sometimes the summer period on stock markets can be rather boring. But there is always a possibility that fundamental factors can swing the market, but in what direction? The movement lower than the level of 1.28 is difficult because of the support, situated at that level, and that can become a strong constraint for EUR/USD pair, it is especially noticeable on long-term graphs. We think that the pair will be moving within this diapason, until the investors and traders can return to the market in August.

Obviously, if the market can leave the diapason of 400 points, where we have been stuck for the recent several months, it would certainly change several things, but one should not rely on it greatly. In fact, in order to make short-term deals it is a great market. But even a trade on 15-minute graphs for small portions can destroy your account, if you are not careful enough.

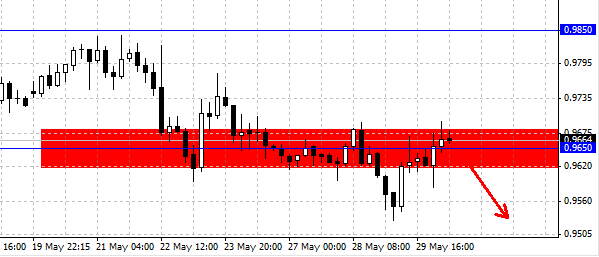

AUD/USD consolidation

AUD/USD pair had a great day on Wednesday, Australian dollar could rehabilitate from minimal value to the base at the level of 0.9650. However the positions occupied would be hard to keep, we think that it is more like a temporary rehabilitation after the prices dropped. This market dropped very quickly and currency investors think that it is an attractive deal to get a cheaper Australian dollar, and it is not surprising at all. However, we do not have any interest to stand it the way of a train that left the track.

We predict that the market of AUD/USD pair will keep decreasing, but we do not exclude the possibility of strong blow at the moment. If we see a strong rehabilitation, there are no doubts that the market is just trying to accumulate more sellers, in order not to leave a trace of the support that has been formed. We think that the growth from the base is over in order to start selling AUD/USD base, with the closest goal of 0.95 and as a result 0.90.