Judging by the importance of the upcoming news, trading this week promises to be quite active. Monday can be considered symbolic of the U.S. dollar during the day, as there have been some attempts to play on the rise of the U.S. currency. But, despite the desire of speculators to warm up before the markets publications outcome of the meeting of the central bank, quotes, currency pairs held by the current narrow ranges. News flow of the most powerful, the degree of potential impact on the markets, the data is expected in the second half of the week. Prior to that, most likely, further consolidation.

Quotes EUR/USD at the moment are at the level of 1.3264 . In early European trading activity, as a rule, grows up, but not by much, as investors have been slow to take positions before the announcement of the FED's decision. According to some experts, the expectations of the speculative rise in the dollar to the September meeting of the Central Bank of the United States are well founded. This is due to the fact that many of the tasks that must be carried out through a policy of quantitative easing is almost resolved. Financial markets have stabilized, the problem of unemployment also retreated. In such circumstances, any positive economic data could trigger the continuation of the dollar.

The main targets for the pair EUR/USD remains unchanged, due to the fact that the markets for quite a long time does not make any substantial changes in price movements. In the case of bullish momentum, the euro could make an attempt to test levels of 1.34 and 1.3550 . This development can occur if U.S. economic data disappointed investors. Bottom pair might find support at levels - 1.3236, 1.3070 and 1.30 . The following is only 1.2750 key level of the story to the speculations about QE.

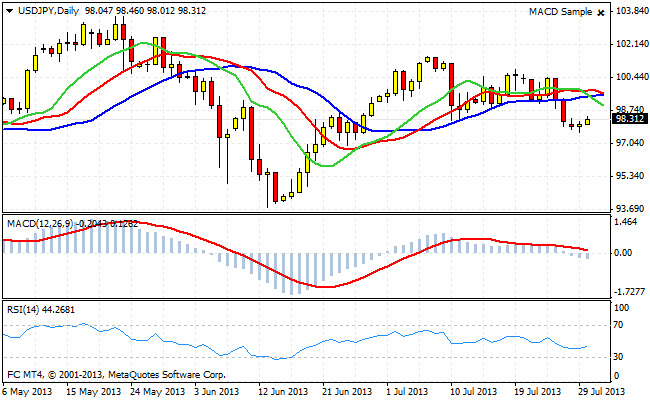

USD/JPY continues to slip from highs near 101. The medium-term trend is now down. The objectives of this movement level - 96.30 and 94. Thus, aggressive long positions on the pair to open until advised. Play the increase in prices will only be possible if the demand for the dollar recovers. In this case, once again updated the old bull in a pair of goals - 102, 104 and 106. Forthcoming publications will have the greatest impact on the stock EUR/USD and GBP/USD. But the trend that will eventually be developed and will certainly affect the dynamics of the USD/JPY.

Good luck trading!

Social button for Joomla