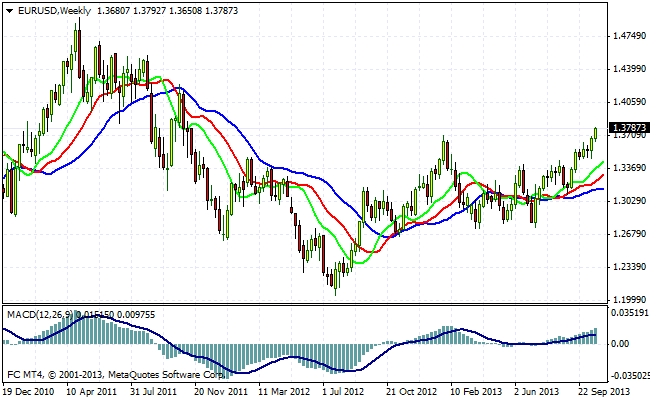

Autumn dynamics in the currency markets continues to impress investors. Just recently, traders, asset managers and analysts of leading investment houses competed in the rewriting of potential targets for major currency pairs against the dollar. But now the situation unfolds dramatically in the opposite direction. The reasons for such a change of the medium-term, and possibly long-term vector for a dollar there are several. Mostly, they are fundamental. But in the current review, we will not deal with the fundamental things and interpretations of economic trends. Below a look at the technical picture for the euro and the pound.

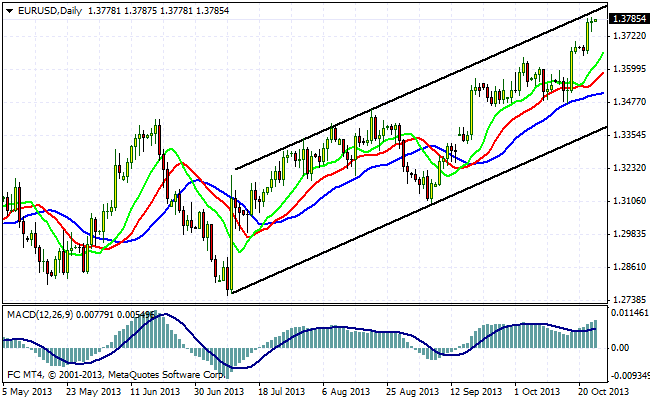

The current value of the pair EUR/USD - 1.3780 . After overcoming a long-term high near 1.37 the chances that the European currency will continue the upward trend has increased significantly. Probably, at the moment there is a total closure of short positions, which were formed in the calculation of the participants for a speedy start to reduce incentives. The next important level in the pair is at 1.4150 . Of course, the achievement of this level implies a qualitative re-evaluate the long-term prospects for the U.S. market. For most players, the situation in the EUR/USD pair is not entirely clear. Borrow short-term or medium-term short positions on the euro is now quite risky. While the guys at Morgan Stanley recommend the use of local growth in the euro to open shorts. Bulls on the European currency can safely pull the floating foot on their long positions. But those who still hopes to play on the rise in the dollar this instrument will have to wait for better times.

The daily chart shows a steady upward movement. Slightly higher current values of the euro may rest against the local resistance, which is represented by a line bullish channel. Current line test can lead to short-term correction of the pair. But as long as the probability that in the next few days we will see the euro below 1.36 is small.

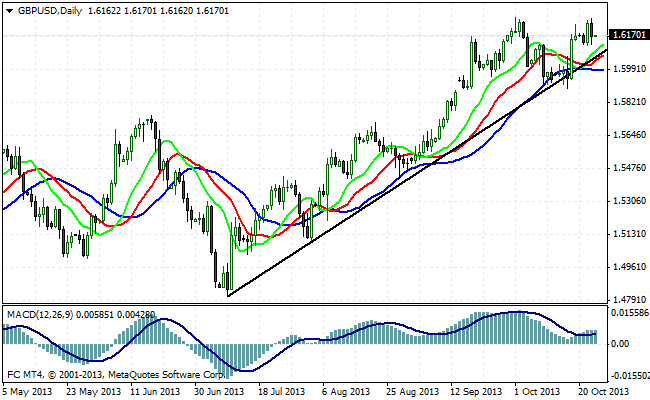

From a technical point of view, the situation in the GBP/USD pair is developing a similar way. Marked by increased volatility on reaching the 1.62 pound mark. It looks natural, as is the area of last year's highs. Probably bet on the fact that these powerful resistance levels will be completed this year, is not necessary. General trading recommendations on this pair may look like this: with aggressive short positions here as well to hold off a bit, but the longer you can cover part or in full, as there is every indication that in the current phase of the upward momentum has become invalid.

So, while all the best economists of the world are scratching their heads over the problem of unjustified as they are believed to reduce the U.S. dollar, the ordinary traders can not wish vigilant and keep a sober view of things. Future unknown to anyone. Therefore, whatever predictions you did not build, always use stops!

Good luck trading!