This week the foreign exchange market is completed without any significant change in prices. The participants have not decided on the motion vector of the medium-term. Minutes of FOMC was able to provide some support for the U.S. currency and, most of all, the demand for the dollar will continue in the beginning of next week. Good data from Europe and China encourage investors to expand the limits on risky assets. Indiscriminate rush in this direction is not observed, as to the key, experts say, the FED's September meeting to make any mid-term and long-term strategy is risky.

The European currency on the trading session on Friday traded mixed against most of its competitors. The attention of the market today will be focused on the publication of data on euro area GDP in the second quarter. Analysts believe that investors are not taking any active steps to the release of statistics, as at the moment there is no confidence in the economic recovery in the euro zone. The revised UK GDP and today the focus of attention currency market players.

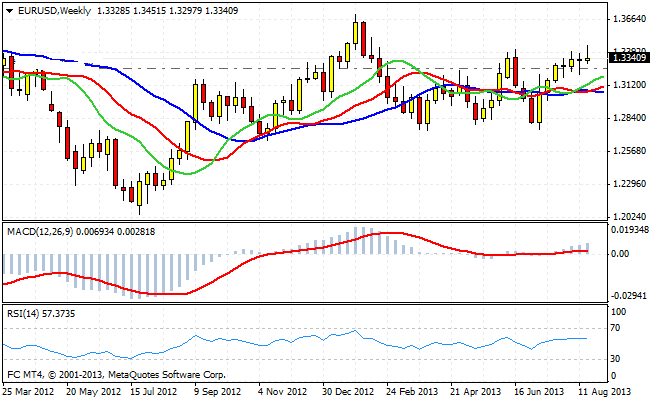

Quotes pair EUR/USD are at around 1.3337 . Long-term technical picture is now neutral-negative for the euro. Unsuccessful attempt to overcome local resistance led to the fixing of 1.34 long positions in the European currency. Talk about a reversal in the dynamics of couples still early, but the premise of both technical and fundamental character for that. Despite the fact that the market has already digested the story closely enough to the reduction of quantitative easing, the players left with many questions. And to speculate on what kind of factor will be the trigger for the release of this long consolidation is difficult. Short positions comfortably open after falling to the level of 1.3270 . For a rise euro now looks marginal event.

Good luck trading!

Social button for Joomla