Bidding on the major currency pairs on Wednesday were in the ranges. Some increase in volatility was seen in the U.S. trading session, but overall significant changes in quotes did not happen. Bearish sentiment slowly return to commodity markets. Investors believe that the Fed's tightening policy will contribute to re-evaluation of risks and buying the U.S. dollar. In addition, investors are worried that China's economic slowdown will increase the negative attitude to the prospects of commodity assets.

Today at 04:30 (USA) will be published data on UK GDP for the second quarter. Some experts point out that the data can be quite strong, as activity in the service sector and the industrial sector is growing. Undoubtedly, good GDP data have already been partially laid players in quotes GBP/USD. But, despite this, it is likely that the pound bulls decide to make an attempt to get out of the consolidation up.

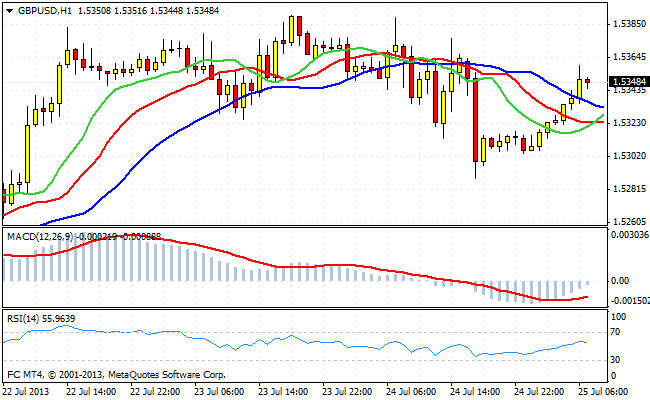

From the beginning, the Asian trading session, quotes cable progressively growing. At the moment, GBP/USD is trading at 1.5355, almost completely blocked the yesterday's decline. After the release of GDP report quotes couples can test the upper boundary of the channel at 1.5390 the three-day and go higher. Above the level of 1.54 is unlikely to now be expected accumulation of sell orders, as most market participants still believe in the strong economic data. At moments of important news, which focused the attention of many players to be ready to take a speculative position in any direction as traffic, usually as a result are rather strong.

The situation in the EUR/USD remains neutral in the short term. Released relatively positive economic data from the euro area were not able to support the single European currency. This fact can only talk about what growth in recent weeks the euro was due to technical factors related to the balancing dollar positions. At 04:00 (USA) will be published by the IFO index and the monetary aggregate M3. These data are unlikely to change the current balance of power in the pair. In the case of downward momentum can open short positions on the euro in order to reach the last local minimum at 1.2750 . The signal to engage bearish positions may pass a local extremum at 1.3176 . In this case, the protective stop can stop slightly above the last peak.

Good luck trading!

Social button for Joomla