The trading session at FOREX market on Tuesday - July 16, runs quietly enough. Partly activity is noted in the USD/JPY pair before the European trading session. In general, the situation is neutral. Apparently the players have decided not to take decisive action before the publication of the FED's Beige Book on Wednesday. Yesterday's weak economic data on retail sales in the United States has not allowed the dollar to resume growth. Thus, the market is now felt certain equilibrium level, get the ball where he can help only significant news.

If we consider the current news flow from the perspective of monetary policy of the FED, the fact that sales data came out somewhat disappointing is likely to contribute to reducing the postponement of redemption of bonds. But this, in turn, can lead to the continuation of short-term strengthening of the euro and the pound against the U.S. dollar.

EUR/USD in the short-cut continues to trade in a range of 1.2970 - 1.31 . As noted above, the markets are unlikely to take efforts to escape this corridor to tomorrow's U.S. trading session. Bearish on the euro, it makes sense to wait until the bull run dry heaves, and will be easy to build its position in order to break below 1.2750 .

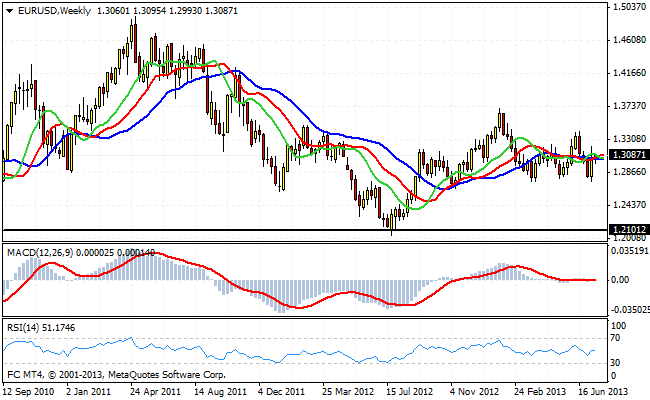

When the market is kind of unexpected strong reaction to any data or on the contrary, there are periods of calm, we always want to turn to the long-term picture, in order to re-check the directions and make some adjustments. Weekly EUR/USD chart looks at the moment neutral negative. No clear technical signals for the development of a bearish trend for the euro yet, but for positive reasons are not predictions.

The key level is still the mark of 1.2750 in the case of overcoming that we will see a very dynamic and three-dimensional movement, since, according to dealers, below this level is a zone of accumulation of pending orders to sell the euro against the dollar. The level of 1.3420 - the resistance, which pass up cancel neutral negative scenario for the pair. But given the fundamental factors that are clearly in favor of the dollar in the coming weeks we will see again testing the level of 1.2750 .

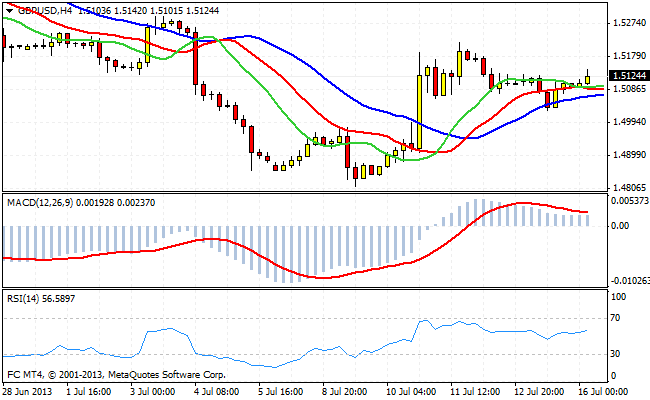

GBP/USD last week, the strength of the important support level - 1.48 . However, the reasons for bullish on the pound is now no. The Bank of England continued loose monetary policy. Therefore, all attempts to couple to "go to growth" can be used to open short positions. The pair is trading at 1.5125 . Published today, the inflation data could have a lot of pressure on the pound, as the decline in these indicators will be another strong argument in favor of further monetary easing by the Bank of England.

Good luck trading!