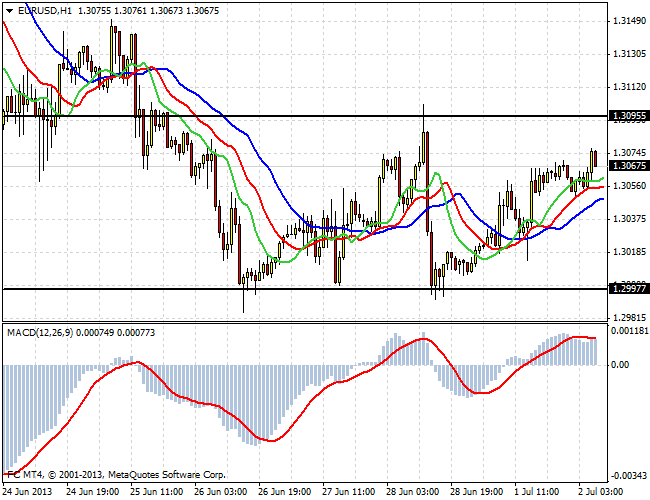

Immediately after the opening of the Asian trading session, the major currency pairs were calm. Except, perhaps, were quotes USD/JPY. Euro opened neutral and gradually grows in European trading. The pair is attempting to test the upper limit of week channel at 1.3090 . District 1.3 proved to be quite a serious level of support for the stock of the single European currency. This may be due to the fact that, as a rule, round values are optional and psychological barriers. At the same time, such a long stop can result in a major boost when the support will still be passed.

Short-term speculators should pay attention to the way the pair will trade at a local line of resistance in the 1.31. It is likely that we will see a false break and return within the channel. In such a situation, you can try to open short positions intraday to 1.30. And for those participants who are more conservative, it's best to wait for the range down and play in the direction of the medium-term bearish trend. The objectives of the bottom is still 1.2820, 1.2740 and 1.2650.

The relatively low activity of trading in FOREX can be due to the lack of significant economic data. In such circumstances, investors always prefer to neutral and passive position.

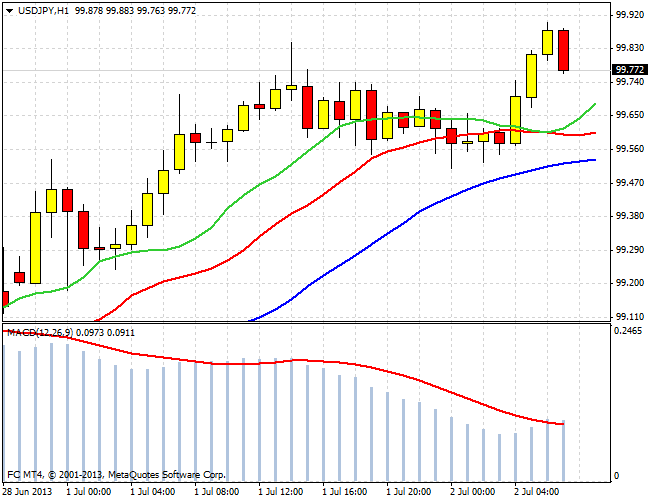

The Japanese yen weakened directly with the Asian trading session. This movement is a continuation of the rising trend of the medium, which was launched on the day of the last Fed meeting. Reaching to 99.90, the pair ran into some resistance. At the beginning of the European trading session, we see the dollar sales. This may be due to profit-taking players on the way to the level of 100 yen per dollar. Apparently, the current pressure on the dollar is short-term.

Open short positions in the fall is not recommended as the primary upward momentum is still in force. It is possible that such short-term bays should be used for the taking of speculative longs.

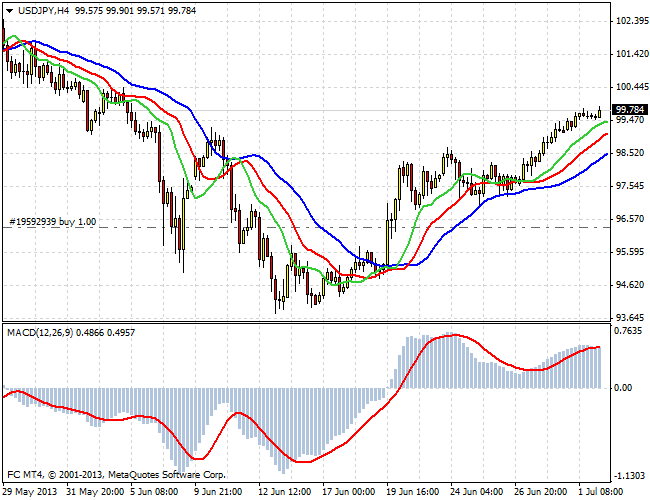

Medium-and long-term technical picture shows that the USD/JPY is in an uptrend. The immediate target levels of this trend are the mark - 102 and 104. The level of support - 96.96. And more important for the long-term trend rate - 94.10. Thus, the game is on the increase in USD/JPY pair continues. Short positions should refrain, but the "long" - you can open or increase, pulling the protective stop.

Good luck trading!

Social button for Joomla