On Tuesday the majors demonstrate calm lateral movement. After a stormy end of last week, players can not yet determine the further short-term vector. Evident is the fact that the dollar will continue to strengthen in the near future. In the financial environment goes a lot of talk about deceived in the capital markets and real estate.

Blowing bubbles such inevitably entail risk aversion and buying American currency. Some experts call it - cleaning the rally. History shows that in times of acute crisis processes dollar is in high demand. We can also assume that the impetus for the development of this scenario can not be curtail the FED's stimulus measures, and some less obvious reason, since in many ways the price of financial assets in many developed countries have overcome all conceivable limits.

Anyway, the upshot of all this situation with the filling of a virtual market liquidity can be quite extensive. Meanwhile, one of the largest insurance companies in the U.S. AIG intends to file a lawsuit against the investment bank Morgan Stanley, which, according to insurers, is directly related to the massive falsification of mortgage certificates. Despite our all new skeletons in the closets of American and European bankers, the main speculation centered around the topic of quantitative easing.

Fed officials have repeatedly said that to start reducing the amount of redemption of bonds necessary to obtain clear signals that the U.S. economy has embarked on even a stable recovery. But as long as there is a high probability that the current improvements are short-term and long-term and medium-term risks are still the place to be.

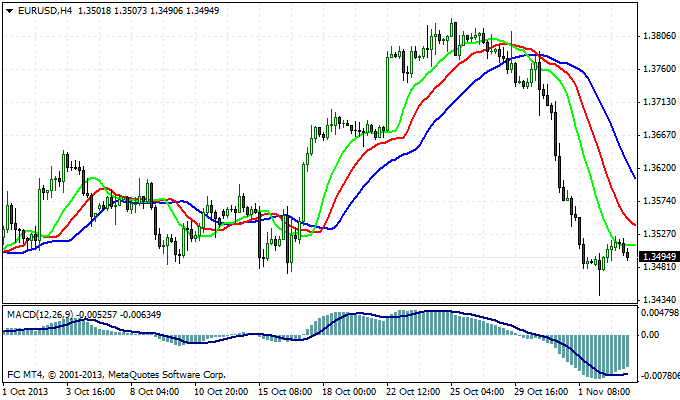

Players in the EUR/USD, slow down a bit at the beginning of this week. This low activity may last up to the ECB. Perhaps market participants want to hear any confirmation of recent hints from the European Central Bank that the incentives will be extended. If this is confirmed, we will see another wave of sales of European currencies. At the moment, there are quotes euro at around 1.3488 . In the near future the most likely scenario is seen couples consolidation in the range 1.3420 - 1.3520 . In the event of a consolidation down, you can open or strengthen short euro positions, placing a protective stop just above the upper limit of the corridor above the specified prices.

Good luck trading!

Social button for Joomla