Last days in the FOREX market are characterized by low trading activity and moderate volatility. Apparently, quotes, currency pairs felt for some equilibrium zone, the output of which will be very dynamic. Fundamental factors that move the markets at the moment, most likely, will be the news of the central banks of the U.S., Eurozone and Japan. Rates of monetary policy the world's largest banks - is by far the main story for all financial markets. Renowned expert on debt markets, Bill Gross thinks that the FED is still quite a long time will not start tightening monetary policy. Finance believes that any decisive action the U.S. central bank may begin only in 2016. In the meantime, according to the expert, the FED will be limited to verbal tools and levers.

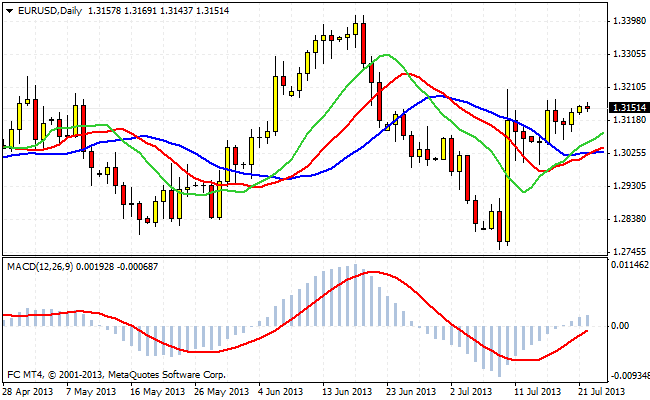

The EUR/USD continues to trade in a narrow range, coming close to the upper boundary. If we consider a short period of time, and it's the latter short-term upward momentum from the support of 1.2750, the pair of quotes about him are in an ascending triangle. Typically, these graphical models are models continue the trend, so the risk of continuation of the upward movement in the next 1 - 2 weeks is large enough. Target levels in a local script will mark - 1.33 and 1.34 . Thus, there is now a good opportunity to play on the break of the triangle. The long-term picture remains neutral to negative, from a technical point of view, and in the fundamental plan.

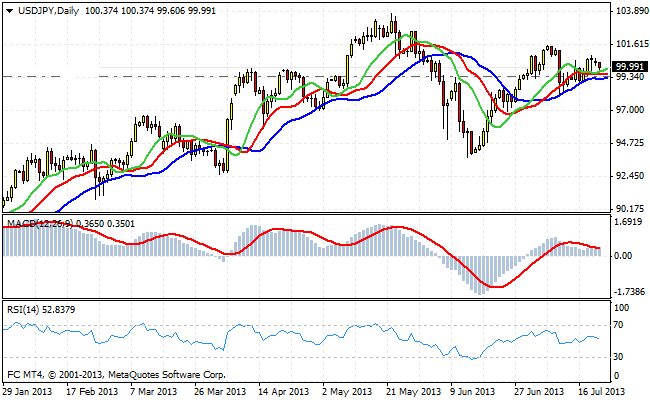

Quotes USD/JPY are also in the correction phase. Here the basic idea - it's parliamentary elections. The Liberal Democratic Party Shinzo Abe scored the highest number of votes. It's in the near future should favor the demand for USD/JPY. If this scenario will be developed, we will again see the players or bring their dollar yearly highs in the region 102 - 103. Long positions makes sense to enhance the passage of a local maximum at 100.90 . Levels of support for the pair: 98.89, 98.22 and 96.96 .

This week is not expected any significant news, so the price action in the currency market is likely to be dependent on technical factors.

Good luck trading!

Social button for Joomla