Since the beginning of the trading session, an increased demand for the dollar. Most likely, the correction phase is over and we will see further strengthening of the dollar against major competitors. The fundamental factors that contribute to this scenario, remain the same investor expectations regarding future monetary policy of the FED. Some experts predict a further sales of risky assets around the world, and care dollar. Markets are closely watching the macroeconomic data, as they determine the rate at which the FED will cut the program QE3.

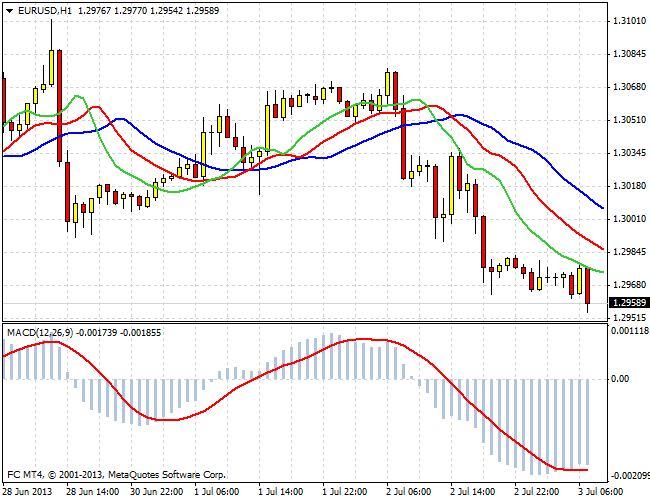

EUR/USD is the correction of the range (1.3100 - 1.3000). It is likely that in the coming hours we will see the trade trigger stop orders below the level of 1.3, and some acceleration in the movement of the pair. Any important news in recent days did not come out, so the current strengthening of the dollar against the euro has a purely technical nature. The risk of growth in the euro exists, and the reason for this may be the high expectations the FED on how to improve the situation in the U.S. economy. In this case, the program of redemption of bonds will not be reduced, and investors will have to rebuild long positions in the EUR/USD.

Another factor that could support the euro may be the result of the ECB meeting on July 4. According to experts, many market participants expect that the ECB will not follow the FED regarding monetary policy. If such expectations will prove too high, it may happen upon closing of short positions on the euro and return quotations above 1.31 .

As for the trading signals that occupy the mid-term long positions on the EUR/USD at the moment is quite risky. Short positions makes sense to hold. The goal of reducing 1.27 and 1.26 .

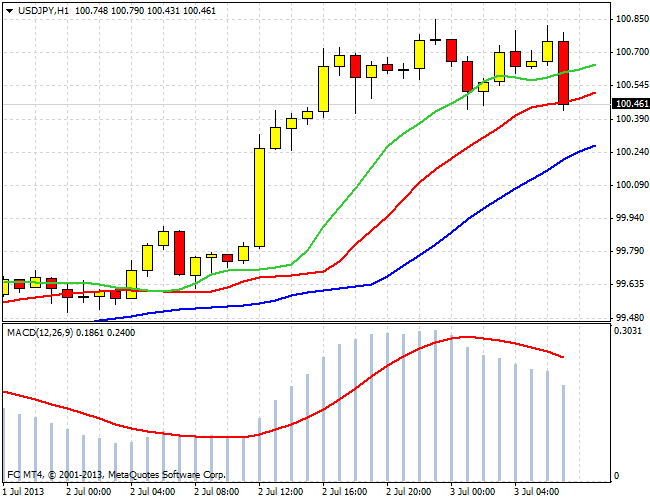

USD/JPY today repeats yesterday's scenario. At the beginning of the European trading session, again there is a dynamic profit-taking and closed positions. In such a fast pace pair may test yesterday's lows at 99.50 . Upward momentum in the USD/JPY is from 93.80 . That's, the pair has added about 7 figures. No significant corrections along the way was not, so now, it is likely investors will take a break, to go with the new forces to storm the annual maximum.

Good luck trading!

Social button for Joomla