The second half of the previous trading week saw a sharp surge in the foreign exchange market quotations. The main reason for this increase was an unexpected increase in the volatility of interest rates the ECB. As a result, investors have arranged the sale of a real European currency across the front.

But the next day volatility subsided considerably, and currency pairs entered the phase of a narrow consolidation. Euro ended the week at 1.3360, while the British pound at around 1.60 . It should also be noted that the data on the U.S. labor market were quite positive. This can help to ensure that the FED will go to reduce the quantitative easing program in December of this year.

However, the views of economists on this issue often diverge. Some experts believe that the FED still will not hurry and take steps this year. Average 32 economists surveyed said that the Federal Reserve will go to the first decline in bond redemption only in March 2014.

Given the scale of currency pairs after the publication of the results of the ECB, we can safely assume that in the next trading session, the speaker will be located within the emerging trends. One member of the ECB Executive Board, Benoit Kere, in one of his comments stated that the main reason for such low interest rates in the euro area is the inability of the economy to recover, and that should not be the first thing to blame the central bank to lower rates. He also noted that investors should not worry about the short-term interest rates, as the long-term rates are still more important and determining the efficiency of investment.

After the markets again, there were rumors of a possible imminent start reducing stimulus the FED, some large investment funds have decided to commit their long positions in gold. About 15 % were reduced positions in gold hedge funds. More and more investors are losing faith in the metal and are looking for alternative means to preserve and increase capital.

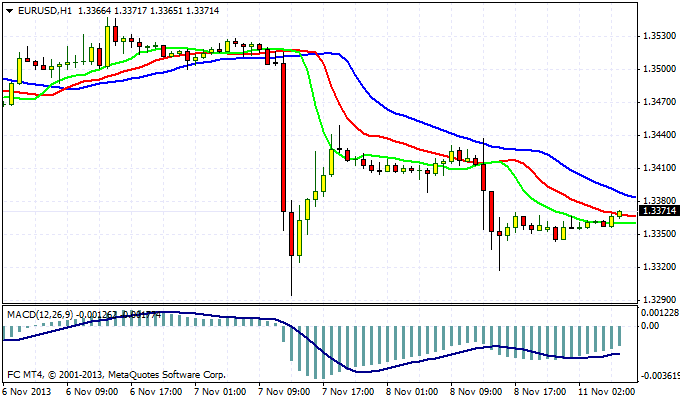

Quotes EUR/USD rising slowly during the European session. Current value - 1.3380 . It's possible that at the beginning of this week we will see the bulls attempt to regain lost positions on Thursday. For full recovery of the players need to improve to get to the level of 1.3515 . Current trend suggests that the likelihood of such a scenario is extremely small. Therefore, you can use any upward momentum in the euro to open short positions to 1.3 .

Good luck trading!

Social button for Joomla