The second day of speeches from Fed Chairman before Congress did not bring volatility in the currency markets. Ben Bernanke went on to do quite restrained statements, citing economic trends. The position of the Fed is extremely clear. In a sense, all the responsibility for further action Reserve shifts the dynamics of macroeconomic data. Market participants continue to monitor the incoming information. The rating agency Moody's yesterday revised its outlook on the U.S. rating to stable from negative. The main reason for this upgrade was provided by data on the situation in the economy of the state, which indicates a steady growth.

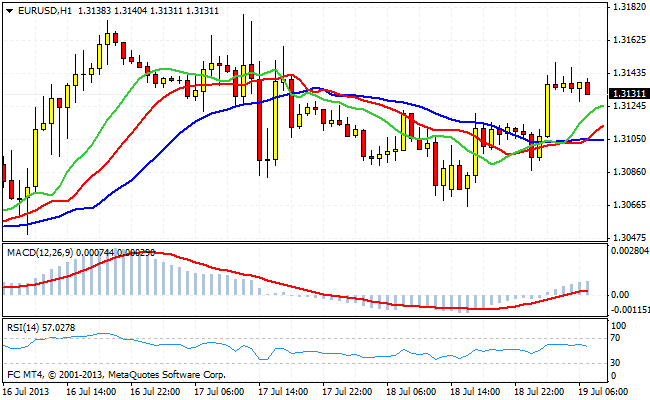

EUR/USD continues to hold a range of 1.3175 - 1.3000 . Despite the positive assessment of the prospects for the U.S. economy, the dollar is still not possible to develop the downward momentum. All attempts to come up to the level of 1.3000 encounter large bids for the purchase of euros. Near the top of the range also observed large cluster of sell orders. Players defend the 1.32 level. If in the near future the dollar will not be able to move down, then most likely, EUR/USD will break through the blockade of offerov 1.32 and will be traded in the range of 1.32 - 1.34 . Overall, in the short-cut dynamics of the pair remains bullish charge.

At the moment, no major fundamental factors that could cause the development of demand for the euro, no. It seems that here we have the technical and psychological aspects. But, nevertheless, if the European currency manages to consolidate above the 1.34 level, the long-term technical picture in the pair will be neutral to positive. The situation in the economy and the banking sector in the U.S. is much better than in the euro area. This situation will soon be reflected in the prices.

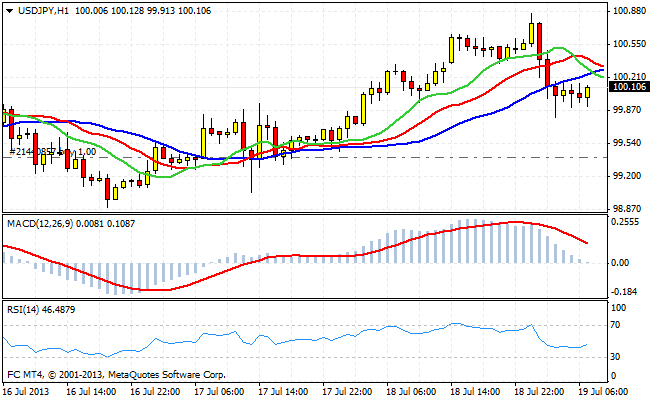

In yesterday's trading session, the pair USD/JPY has lost some of its positions. Showing a maximum of 100.86, quotes pair slid to the area of 99.70 . This corrective movement is in the upward momentum. The objectives of the dollar is 102 - 104. In the beginning of the European session, the pair resumed growth and is trading at 100.27 . The earlier opened long positions can be held by moving the protective stop.

Among the fundamental factors that have a particular impact on the yen, it is possible to note the publication of the report of the Bank of Japan on the movement of capital. It says that last week, investors from Japan were net buyers of foreign bonds. This suggests that the policy easing works and investors are looking for yield outside the country. If this trend is to continue, it will contribute to the further weakening of the yen and the positive impact on the flow of exporters.

Good luck trading!

Social button for Joomla