At the end of the last trading week of any sharp currency fluctuations were observed. On the contrary, sometimes the volatility has continued to decline. This may be due to the fact that the FED is nearing a regular meeting, which is scheduled for Wednesday of this week, and because of this fact, most players prefer to avoid action. As always, market participants expect the representatives of the U.S. monetary authorities of any specific allegations to determine the medium-term vector. If the FOMC accompanying statement will not contain abstracts that can provide support to the U.S. currency, it's quite possible that we will face a wave of sales for a dollar.

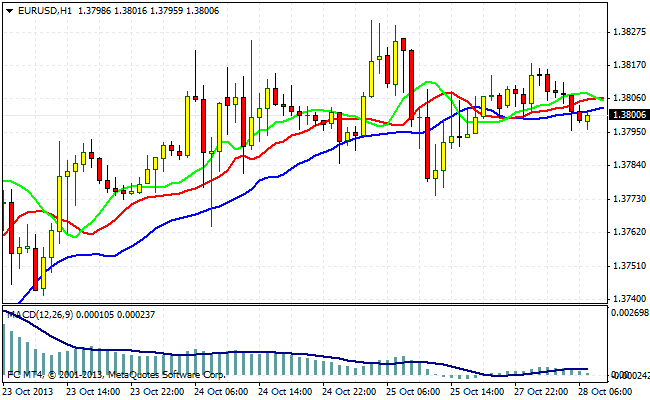

Quotes of the euro at the beginning of the trading week are near the mark of 1.38 . Any aggressive bursts quotations EUR/USD to the outcome of the FED should not wait. Investors are less inclined to believe in the imminent reduction in the FED's quantitative easing program and more and more trust in the euro. Despite this upward trend of recent weeks in the pair EUR/USD, market participants surprised by the fact that the ECB President Mario Draghi at the last press conference, did not even bother to comment on this particular point. Thus, we can conclude that the current levels in the pair are still in a comfort zone for the Eurozone.

The nearest resistance level for the euro - is the level of 1.3830 . Above 1.3855 dollars as dealers said, was a slight accumulation of sell orders relating to options positions. Bottom until the price movements of the pair can be restricted to the support levels 1.3770 and 1.3740 .

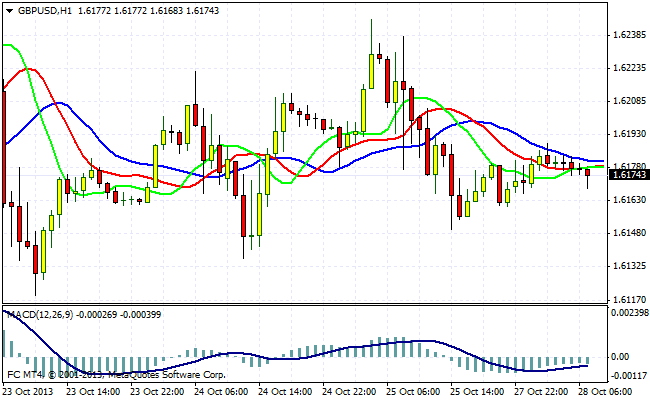

GBP/USD pair is not yet able to overcome resistance at 1.6250 . Quotes of the cable are in the range 1.6130 - 1.6250 . Output from this zone up consolidation is possible only if the market will come negative data on the U.S. economy. Since the current local resistance is also a long-term key level, the upward momentum in the case of breaking 1.63 mark, it may be quite ambitious.

Among the fundamental factors that support the medium term quotes pound, you can note the positive GDP data for the UK. At the end of last week, investors pleased report on the economic growth of the country, where there was a marked increase in GDP in the third quarter to the maximum in the last few years, the value - by 0.8 %. Thus, the recovery of the British economy is in full swing in almost all the sectors. All this supports the demand for the pound.

Good luck trading!

Social button for Joomla