Trading in the FOREX market on Monday held in moderation. The past week has been rather volatile, and the reason for this was neutral comments from FED Chairman Ben Bernanke and a number of macro-economic data from China. The situation in the Chinese economy worries many market participants. Representative of the Middle Kingdom financial authorities forecast a further slowdown in economic growth, and this will adversely affect the commodity currencies, and on the desire of investors to invest in risky assets. FED policy takes into account the situation in their forecasts in China, so market participants will closely monitor the actions of the Federal Reserve and the rhetoric of its president.

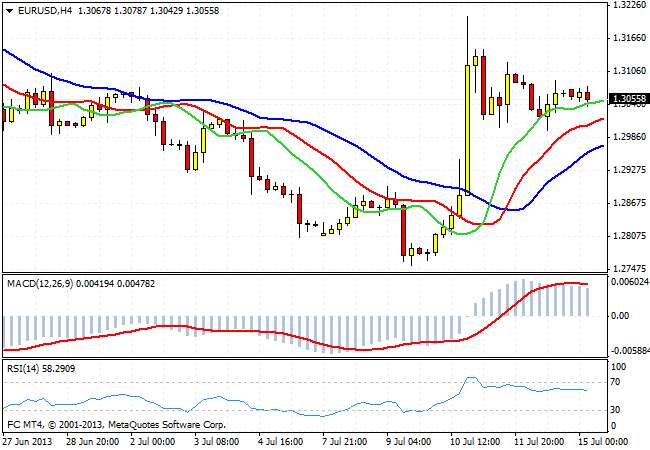

Trading in the EUR/USD is at low volumes. After opening the Asian trading session at the level of 1.3050, the pair continues to consolidate and plane motion. Presumably, the participants will be waiting for the FED's Beige Book, the publication of which is scheduled for 14:00 (USA) on Wednesday. In the event that the euro will continue to decline in the medium term towards 1.2750 support previously achieved, the opening short positions, based on the breakdown of this level of care and the euro at 1.21, is justified because of the high ratio of return to risk ratio. Your stop can be placed just above the local maximum. In the meantime, the market place has low activity and the lack of directional speakers, then take the aggressive position is not recommended.

Some experts point out that the players overestimated the positive factors for the euro. And, it is likely that in the second half of the week demand for the dollar will resume. There are political issues to consider in a number of countries in the Eurozone, as well as weak economic data, the mere fact that the quotation EUR/USD are above the psychological level of 1.3 tells us that investors are still poorly laid under the growing risks for the euro. This situation creates a certain irrationality, which is resolved in the near future.

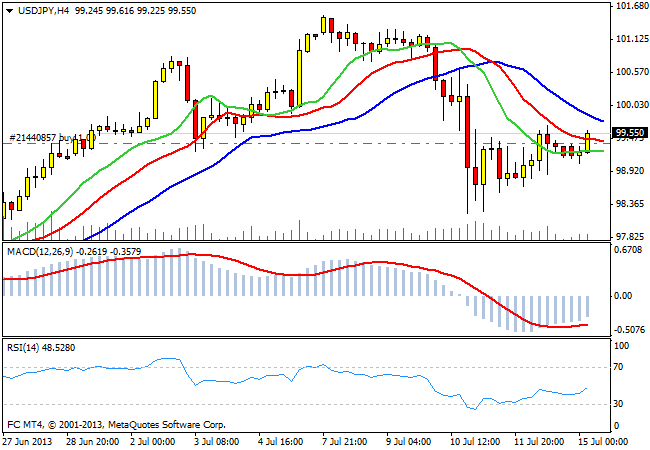

USD/JPY makes attempts to develop an upward movement. Last week, a pair of quotes reached lows near 98.20, and then consolidated in a narrow range. Week USD/JPY closed at 99.20 . At the moment, the fundamental reasons for the growth of the pair are very serious. The Bank of Japan has signaled that he intends to continue loose monetary policy as long as it takes to get out of a deflationary cycle. Positive for the dollar point is the fact that Japanese investors are again buying foreign bonds by selling the yen.

Target of USD/JPY remains the same: 102, 104 and 106. Significant support is at 94.00 . While a pair of quotes above this zone, only makes sense to work from Long.

Good luck trading!

Social button for Joomla