In the second half of the week the European Central Bank gave a surprise to market participants. The next meeting of the ECB, according to most experts, was to be held in a peaceful manner, without any indication of change in the current course. But the regulator still decided not to delay efforts to maintain liquidity.

As a result, the interest rate on the MRO has been reduced to 0.25 % from 0.5 %. Thus, short-term loans in the banking system have become even cheaper. However, in recent years banks not actively using this mechanism. At the moment, most of the banks compete for liquidity in the LTRO. All this suggests that the perceived yesterday's rate cut shouldn't be so aggressive. However, the foreign exchange market quotations euro responded by sharply increased volatility and as a result literally collapsed in a few minutes.

At the press conference, Mario Draghi said inflation continues to decline and there are significant risks of a scenario in which inflation will remain at extremely low levels for a long time. ECB President also noted that the regulator will monitor the situation in the money market and to keep monetary policy flexible as long as need be. According to Draghi, the euro zone economy is still in a high risk area.

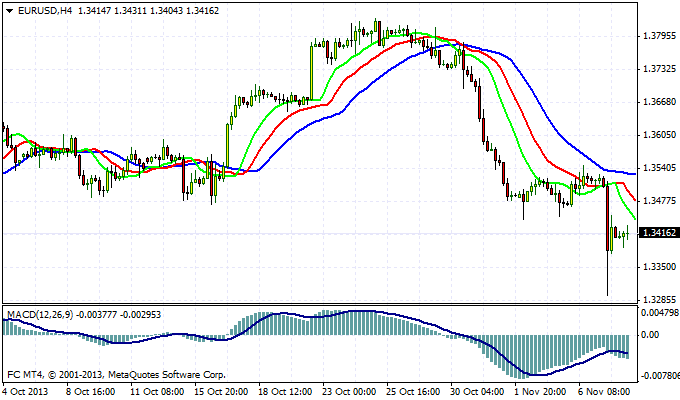

Prior to the publication of the results of the ECB, market participants did not show much activity. Rate cut is practically no one really did not expect, respectively, the market did not put it in quotes. As a result, the euro collapsed. EUR/USD for 2 hours with a mark of 1.3520 plunged into the zone of 1.3290 . It's a little more than two shapes for the pair. But not long after the massive sell-off stopped euro groped support and gradually began to recover and reached a level of - 1.3440 . At the moment, quotes couples are in a phase of consolidation around 1.3420 .

Technically, EUR/USD is now open the way to 1.3 and lows in the 1.2750 area. Will try a couple medium-term uptrend to resume or continue to decline, will depend on the incoming data on the U.S. economy and the euro zone. Today's data on the U.S. labor market can cause short-term fever in the markets on the scale is not less than the ECB rate cut. Positive data can contribute to the development scenario of further strengthening of the dollar.

Good luck trading!

Social button for Joomla