The strengthening of dollar slowed down and there is a consolidation on currency markets. The participants are waiting for new information and are forming positions. The renewal of activity on Forex can occur today after publication of macroeconomic data. At the beginning of American trading session investors will receive information about the situation on real estate market, as well as data about the durable orders. Any positivity will most likely be considered as an argument in favor of folding monetary stimulus.

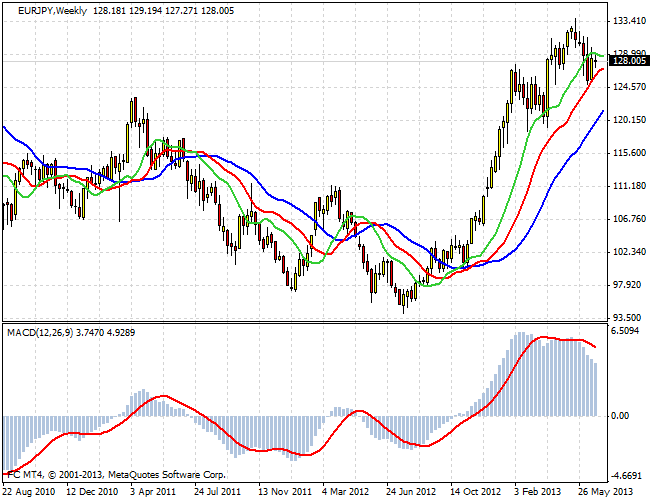

A pretty interesting technical picture is visible in EUR/JPY currency pair. At the moment the pair is in the phase of correction towards the annual bull trend. The levels achieved within the boundaries of this trend (133.10) – is the area of long term resistance, which happens to be the area of consolidation of 2009. On the one hand we have a potential weakness of Euro and appropriate risks on the other hand, the intention of Japanese Central Bank weakens Yen. Now it is better to refrain from carrying out active transactions. It is necessary to wait for break in one of the directions.

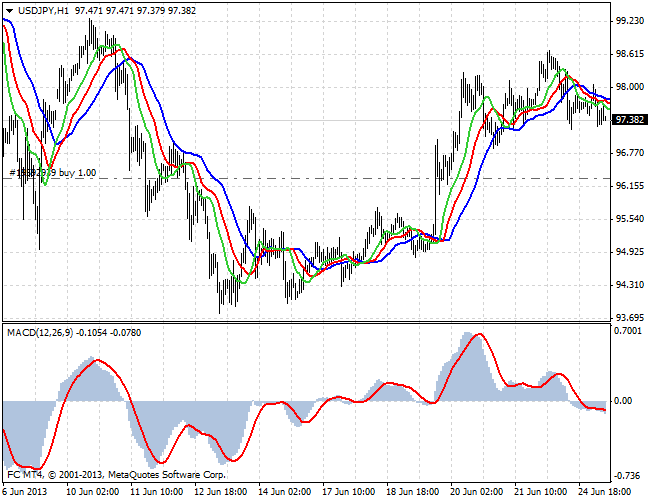

There was not a quick ascending in USD/JPY towards maximum of 103.30. As a result the pair achieved local resistance level of 98.50 and is consolidating in this area. All the descending impulses can be used to open long positions on USD/JPY. The bull model will be broken only if we see lowering to 94.00 and lower.

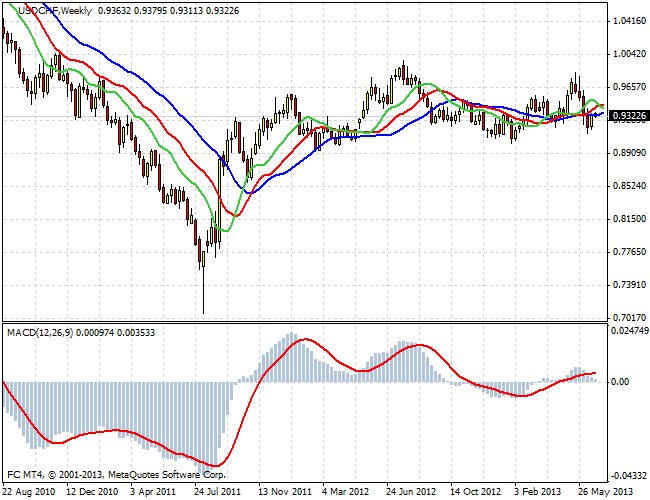

USD/CHF graph has been an example of long-term consolidation over the last one and a half years. After the pair finished lowering in July of 2011, we saw an abrupt rebound and the following trading in the narrow diapason, which runs there up to this day. The scope of the corridor: 0.9900 - 0.9010. As a rule after such long dormancy the markets conduct very potent directed movements. Thereby we expect a signal to leave the diapason and look for opportunities to open positions towards the break. Resistance levels - 1.1650, support level - 0.7000.

Social button for Joomla