ECB meeting held no surprises, the interest rate has remained at the same level. Draghi said the bank's monetary policy will remain soft. The head of the European Central Bank does not rule out any further easing. In addition, in the comments, it was noted that the ECB is ready to launch OMT program at any time. But while it's still only at the level of conversation. Experts believe that the special effect of lowering the deposit rate below zero can be expected.

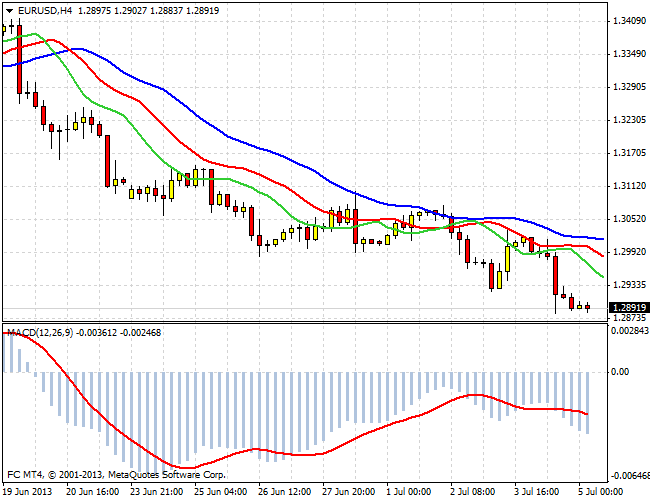

EUR/USD to the publication of the results of the ECB reacted to decrease by about one piece. Market participants decided that the euro has virtually no prospects for medium-term period of time. The pair quickly fingered the level of 1.2880, and is trading near it. Current downtrend develops. Short positions should definitely hold, because at the bottom there is a lot of goals. These levels are 1.27 and 1.26.

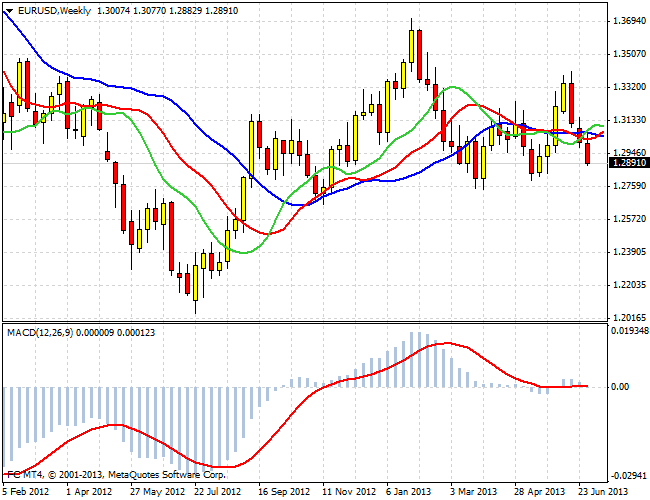

The long-term picture is more bearish. 1.2800 - 1.2750 area - an important area of support, the passage which opens the way to the levels at 1.2000 and 1.1800 . Those players who are currently on the fence, to actively join in the game after 1.2750 . If this happens, the trade in the pair must be carried out only by "short".

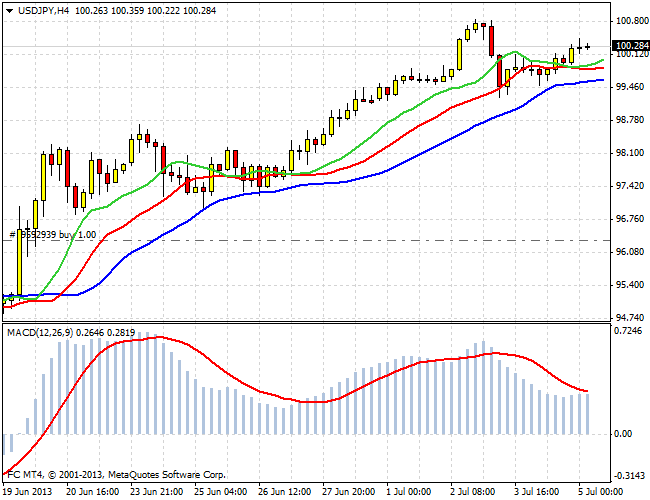

Short-term correction in the USD/JPY seems to end. The upward trend for the pair remains on the agenda of the local maximum in the testing 100.80 . It also makes sense to hold open positions in the earlier increase in the dollar, pulling the protective stop.

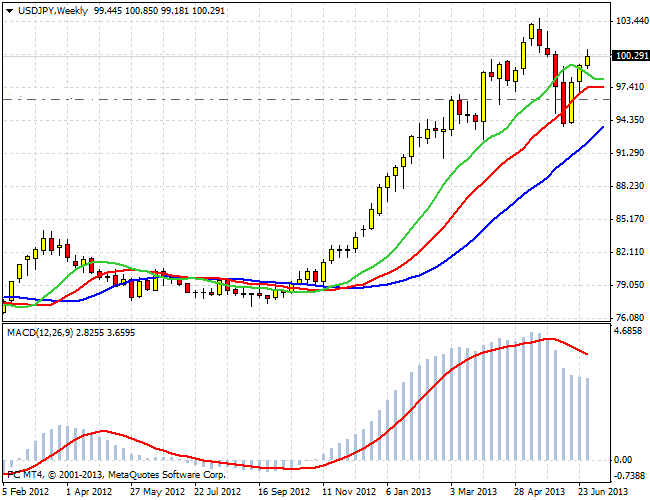

On the weekly chart clearly shows bullish trend, which dates back to September of last year. The increased volatility in recent years, according to experts, is related to profit-taking by foreign bonds by Japanese investors and purchases yen. A number of strategists of the leading investment banks believe that such a stop in reducing the yen - a temporary phenomenon, and that in the future we will see continued strengthening of the dollar. The main reason for such a scenario can be returned to operation modes carry trade, in which the Japanese Yen has always acted as a funding currency. In this case, the long-term goals for the pair may be the levels in the 106 - 109 yen per dollar.

Important macroeconomic news today is to provide data on the U.S. labor market, which will be published at 9:30 am. American trading session promises to be very active, because yesterday was a holiday in the states.

Good luck trading!

Social button for Joomla