The past week was marked by the strengthening of the U.S. currency. Bearish on the dollar had to surrender their positions. This demand for the U.S. currency may be caused by the expectations of the September meeting of the Federal Reserve, as well as positive data on the U.S. economy. Today, in the states of the output for the occasion. In this regard, the currency market players will be focused on the data from Europe. On the strong volatility on Monday should not count.

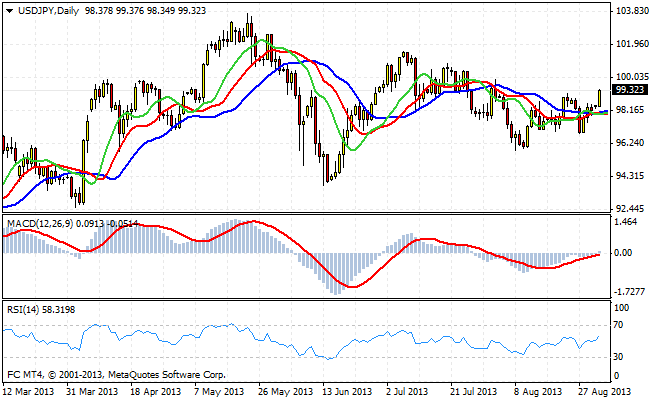

Beginning of the current decline in the trading week the yen . The return of demand for the dollar in the pair USD/JPY may be due to the fact that the geopolitical factors that have repeatedly in the past led to the growth of the Japanese currency, gradually fade into the background , giving way to economic.

The pair held the local resistance at 99.15 . Overcoming that level opens the way to move towards the level of 101.10 . Open long positions on the dollar in the current situation is quite comfortable. Medium-term goals can act levels 102, 104 and 106. Protective stops optimally placed slightly below the local minimum. Thus, if the conflict in Syria will not be developed, then the above stated objectives - can be fully achieved by the end of the year.

EUR/USD is consolidating at progress, last week, levels. While the 1.32 mark resisted , but the bears are determined on the euro and in the coming session is likely we will see this support trying to flash and go to the area of 1.31 - 1.30 . The trigger in this short-term scenarios may be strong economic data from the U.S., which will force investors to believe in the recovery of the U.S. economy.

Good luck trading!

Social button for Joomla