Despite the fact that the market has a lot of skeptics in regard to the future prospects of the dollar, the experts of a number of large investment banks are convinced that the dollar is currently on the verge of a powerful wave of growth. So UBS believe that an increasing number of members of the Federal Reserve will maintain the initiative on QE3 minimize the program and the transition to tighter monetary policy. Due to the fact that the current week is not very rich in news, the main topic of discussion is the situation in the U.S. labor market. Tomorrow, the publication of the minutes of the Fed meeting, resulting in the dollar could get support.

EUR/USD shows growth from the beginning of the Asian trading session. The reason for this can be the local technical "oversold" pair. This situation can be used to open short positions on the euro. It is possible that the psychological level of 1.3 will again be tested players. Short-term expedient while participants take a passive approach and wait for the resumption of the downward momentum. And for those players who have taken long-term short positions, should continue to hold them.

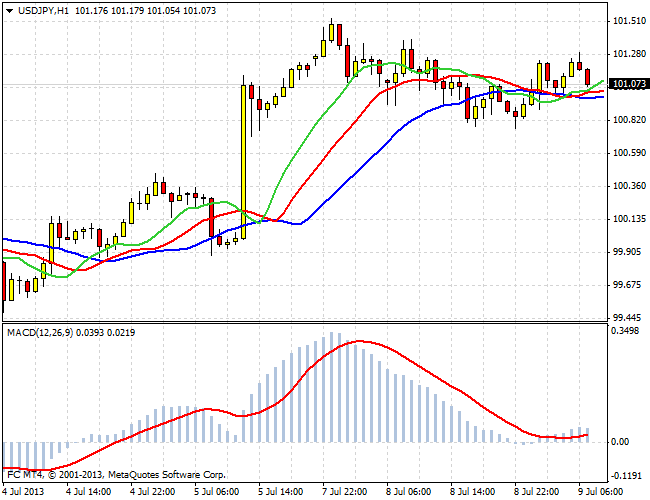

USD/JPY since yesterday traded in a narrow range with a slight downward slope. Stopping the growth of the dollar against the Japanese currency caused by a number of factors. First of all, this is a technical point - the levels reached speculators pushing on profit-taking and liquidation of long positions in the dollar. As for fundamental reasons, it is worth noting a morning publication of information on the Japanese economy. In particular, the growth of the monetary base was regarded by investors as a positive signal to economic recovery, and instilled confidence in the fact that the soft monetary policy has the intended effect. Now all the attention of market participants focused on the upcoming publication of the results of the Bank of Japan. The pair is trading in the range as long as 101.50 - 100.70 .

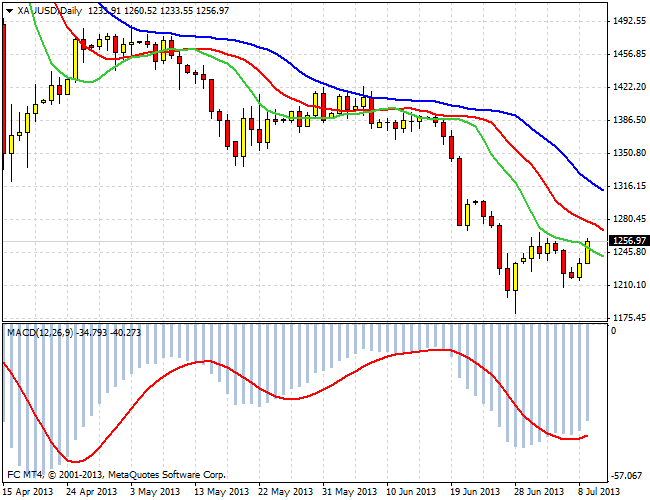

Corrective movement is gaining momentum, and in gold. Current quotations metal - 1.256 dollars per ounce. This corresponds reached at last week's highs. Thus, the dollar temporarily retreat on all fronts. The immediate objectives are the correct level of 1290 and 1320 dollar. Investors who want to take a long position on the instrument, it is not necessary to hurry, since it is likely that the minima, we have not seen yet.

Good luck trading!

Social button for Joomla