Despite remaining at the moment the upward trend for the dollar, the chances of a significant correction movement across the front are quite large. As part of the bullish trend dollar reached a number of important levels against the major currencies, and now some market participants are preparing to play in the opposite direction. Arguments for the classes of aggressive speculative positions today may be enough. This data on changes in the volume of euro area GDP (13-00) solutions at the rate of the Bank of England and European Central Bank (15-00 and 15-45). In the United States today are celebrating Independence Day, so the stock exchange and banks are closed.

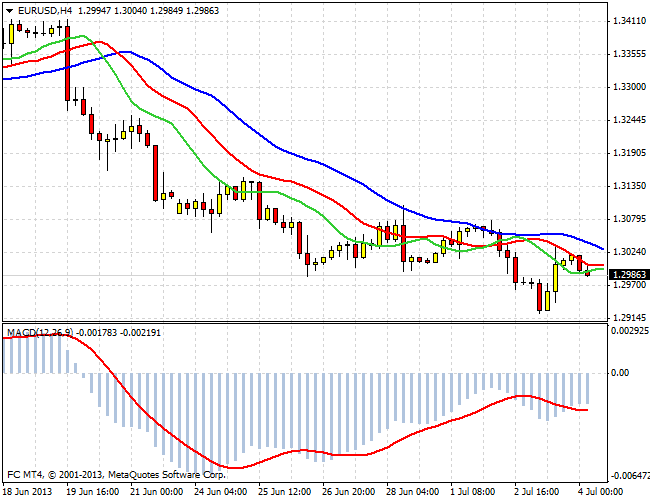

EUR/USD during yesterday's trading session, an attempt is made to approach the level 1.2920, which was faced with substantial support. After playing up one figure, the pair is trading today near the level of 1.3 . We must assume that in order to overcome this psychological level the market should go further information. If you look at the situation from a fundamental point of view, the risk of decline of the euro can be realized because of the political crisis in Portugal. In this regard, investors will be watching closely today's Draghi comments on this situation. If the EUR/USD did not manage to gain a foothold above 1.3, there is a high probability of renewal sales and the game to improve the dollar.

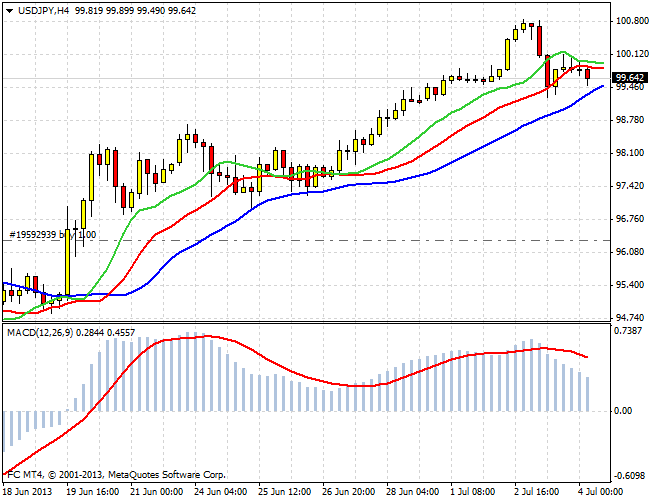

Active buying yen for dollars has become a mandatory procedure in the European session. In the zone marked by increased volatility 101 - 99, which may be a sign of temporary stop of the uptrend. But if the level of 99 still stand, the goals for the game to improve a couple of levels to 102,103. In the breakdown of the mark 99 is down to refrain from opening long positions and wait for a recovery in demand for the dollar.

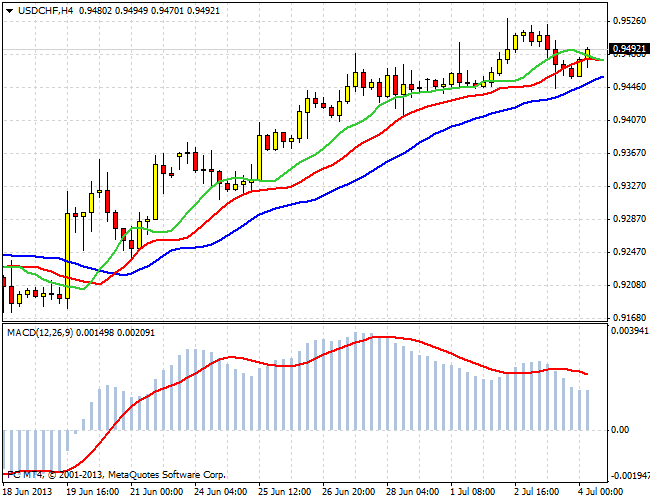

USD/CHF is trading within a 3-week uptrend. Reaching the level of 0.9525, the pair made a pullback to 0.9450 . At the moment, there is again upward momentum. But before the publication of the news of the central banks can hardly expect major movements. Long positions should hold the pair, placing protective stops at local minima.

Good luck trading!

Social button for Joomla