The statement made by member of the European Central Bank Governing Council Ardo Hansson, insured that the regulator will continue to widen expansionary actions and reduce deposits’ interest rates up to the negative rates, had almost no effect on the foreign-exchange markets. Thus, the policy of gradual currency quantitative easing made by central banks will last for a long time.

Last weekend the USA and Iran reached some agreements on Iranian nuclear program. Participants of oil market reacted immediately closing long-term positions, as the military premium will be evaporated. At the same time, the demand for the risky assets was recognized worldwide.

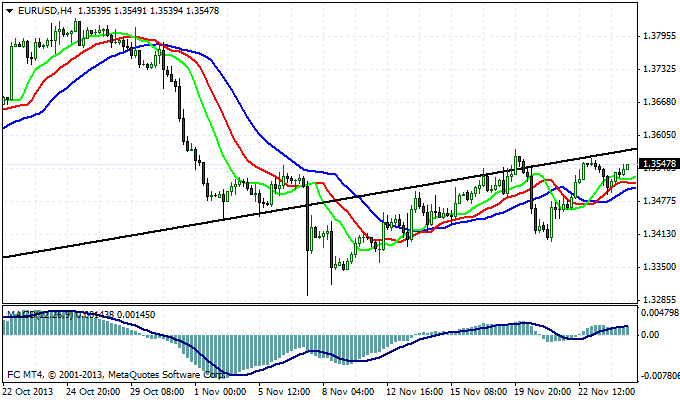

European currency quotations are now at 1.3555 and try to come back to an upward trend again. But still, the sellers’ pressure exists and the pair can not develop the full ascending impulse. If quotations fall down again and the local extreme will be reached at 1.35, which was firstly tested by market participants yesterday after Ardo Hanson statements, then it will lead to the minimums at 1.33. Thereafter, the reaching of 1.36 could be a signal for the occupation of short-term long positions of euro. The long-term prospects do not change; the European currency is still between 1.38 and 1.33. It can leave it quite dynamically.

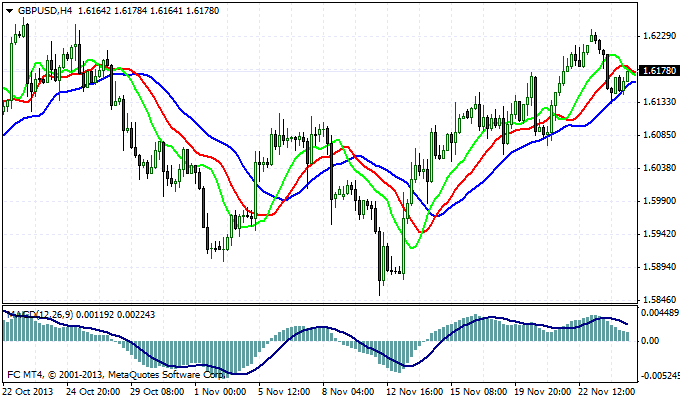

GBP/USD has been increasing during today session. The pound quotations are close to 1.62. The nearest resistance is at 1.6240. At this rate the pair can stop moving as bears will fight for it. Now, the middle-term upward trend takes place. From the technical perspective, the situation will change provided that British pound quotations will fall to 1.61 and further. In this scenario we can once again observe its quite sharp down-drift to 1.5850.

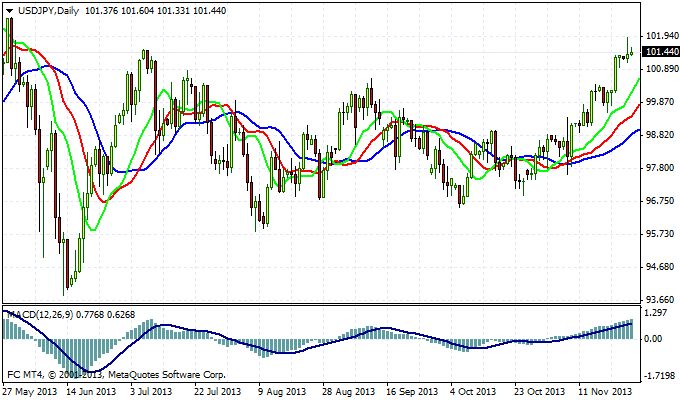

A USD/JPY raise has slowed down. The pair has reached local extremes and begun to decline during yesterday session. It seems that the further sessions will show the adjusting movement, with the goal to reach 100 point. When bulls will cool down a bit, it will be possible to reach new maxima of the year.

There are not so many important macroeconomic data this week. There is little news from the real estate market and consumer confidence indexes. The direct FRS statements attract market participants’ attention, not the subjective assessment of the data. Undoubtedly trends of the economic parameters have their impact on the FRS policy. However, it will be safer to be guided directly by chiefs of the monetary and credit policy.

Have successful trading!

Social button for Joomla