Despite published in August of interesting macroeconomic data, the major currency pairs continue to drift lower level of volatility. It seems that in the near future we will see a way out of quotes from well-established ranges. Given the length of this phase is no trend, the movement is rapid and high amplitude. The first signals of an impending storm is coming from the stock markets of the world, where there is increased volatility in the background begun reduction indexes.

In low concentrations of important news coming out this week in the markets dominated by technical factors. The situation with the euro at the moment all the more ambiguous. Many analysts wonder why the couple has not yet begun to regain expectations related to the reduction of quantitative easing in September. For a while, the demand for euro interest explains the presence of the Japanese investors to European assets. But the latest news from the German central bank added unexpected arguments in favor of the euro. Bank representatives said they would not rule out monetary tightening. It turns out that the actions of the ECB and the Central Bank of Germany could be totally consistent. In such circumstances, investors are more likely to reduce risk and build close to neutral - currency positions.

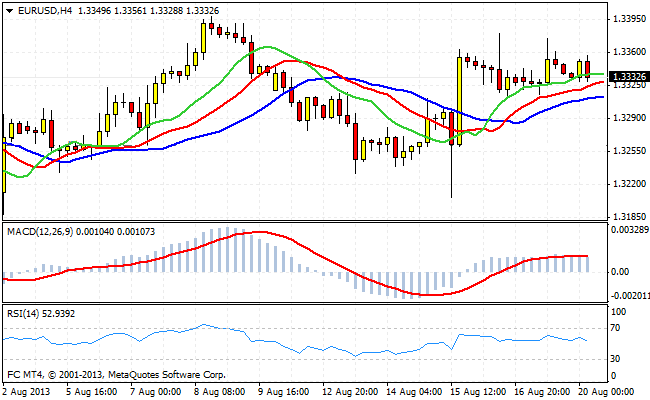

In the beginning of the European session, there is some increase in activity in the pair EUR/USD. Opened lower on European indexes partially put pressure on the euro. The technical picture indicates a high probability of congestion stop orders above the level of 1.34 . Players who are waiting for the moment to start game on the decline of the euro can not wait to pass the level from the players or 1.34 . And in the event that after the collapse of orders to consolidate and confirm the sample fails, you can search for points of classes of short positions.

Good luck trading!

Social button for Joomla