In recent weeks, the dollar has made a very serious bid for the long-term growth. In this regard, his abrupt departure this week is the subject of much debate among traders and analysts. Skeptics on the dollar in one voice insists that the markets since the beginning overestimated the FED's willingness to take decisive action, and that such a total purchase of U.S. currency was no reason. So as soon as Ben Bernanke's rhetoric changed to neutral, market participants revised their forecasts and have had to close a lot of long dollar positions. If the quote currency pairs will not change much until the end of Friday's trading session, the first time in a month dollar closes the week lower against its major rivals.

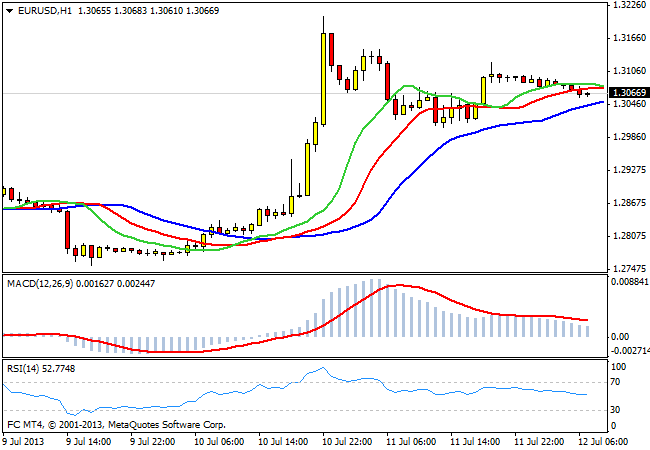

EUR/USD on Tuesday set a low at 1.2755, followed by statements by FED Chairman made great strides in the north and reached a one-week high at 1.3260 . Such pulse typically has a high degree of inertia, so the demand for euro likely to persist in the early weeks following trade. Some dealers noted that market participants are prepared to continue the game to increase the dollar, but still waiting for the right moment to open positions. The level of support, from which there was this pullback on EUR/USD, and it's a key passage gives the green light for the reduction of aggressive play on the euro.

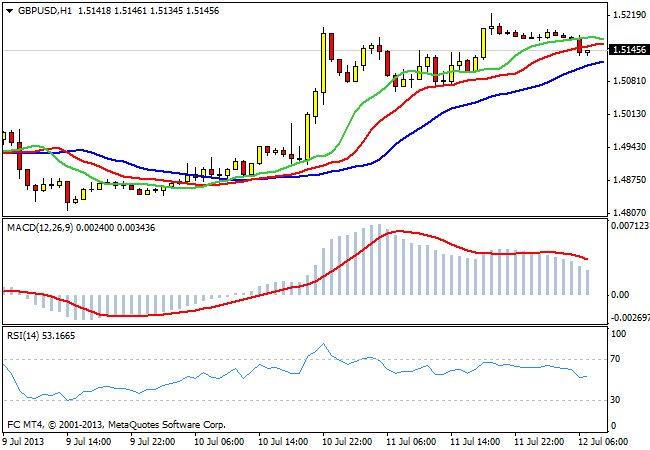

Very similar dynamics demonstrates the pair GBP/USD. At least a week - 1.4815, and the maximum - 1.5220 . Given the fact that the Bank of England, as the ECB does not intend to in the near future to move to tighten monetary policy, market participants reacted to the speech of Ben Bernanke as aggressively as the market EUR/USD. According to analysts, this situation is short-term and in the near future again players will want to test the strength of support for cable.

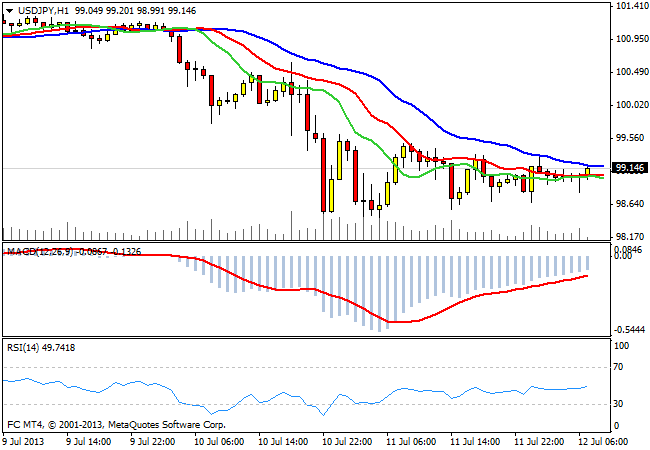

Quotes USD/JPY are at 99.00 at the beginning of the European trading session. Yesterday's statement by the Bank of Japan's monetary policy contributed to some increase in volatility in the pair. The positive changes in the economy, the growth of the monetary base - all this, in the opinion of the representatives of the monetary authorities of Japan should positively affect the growth of inflation expectations. The current rate should lead the economy out of a protracted deflationary cycle.

Long-term trend for the USD/JPY is bullish. Perhaps now it makes sense to enhance the long dollar positions. 99 - 95 zone - is a comfort zone for shopping dollar against the yen. The objectives of the same: 102 - 106 yen per dollar.

Good luck trading!

Social button for Joomla