Stability and reliability can be called the main characteristics any of the trading robots should possess. The 10 Pips expert advisor focuses exactly on these components. The basic idea of the trading algorithm can be stated as the following: let the profit be less, but constant.

Any 10 Pips expert advisor is primarily based on the psychology of the crowd. The fact is that many traders establish TP and SL orders on daily extremes. Therefore, when there is a breakthrough of the high/low of the previous day, the price for some time continues to move in the direction of the breakthrough by inertia due to the triggered orders.

The task of the expert advisor is to take at least a part of this movement. To improve the stability of the MTS, the expert advisor closes the deal as soon as the profit reaches 10 pips. However, there are 2 options of trading: using trailing stop or partial profit taking.

Algorithm of the expert advisor is not very complex, so there are many variations of it out there. Some of them offer trading at a smaller timeframes (e.g. h4), other trading robots offer not to use SL, but get rid of losses by averaging or Martingale.

How 10 Pips expert advisor works

In its basic version of the strategy, the expert advisor continuously monitors the level of prices and compares it to the extremes of the previous day (only the previous day is taken into account). As soon as the price crosses the high/low of the previous day, the deal respectively to buy/sell is opened.

TP level is set at 10 pips, it would be logical to set SL at the opposite extreme, but in this case the ratio of profit/loss is too unprofitable, so often a fixed SL is used. Its value is given either in the settings of the expert advisor, or is set under the nearest extreme on a smaller timeframe (depending on the algorithm of the expert advisor).

There is also an expert advisor of the same name, but with a completely different principle of operation. This advisor is aimed at trying to make trading profitable regardless of the direction of the trend. It is used to simultaneously open the divergent positions, i.e. for hedging.

According to the algorithm of the expert advisor, the same SL and TP are set for each deal. If the deal is closed with a profit, the next couple of positions are open in the same lot, but if the SL triggered, the value of the next deal increases. In other words, the principle of Martingale is used.

10 Pips expert advisor and the principle of Martingale

Adding Martingale to the described trading technique can significantly increase the profitability of the strategy, while maintaining the basic idea of trading. However, no SL order are used at that, and the size of the deposit faces increased requirements – its value should allow to wait long-lasting losses.

The algorithm of this modification of the expert advisor can be called one of the best in terms of stability and reliability. It takes into account three scenarios:

- price after the breakthrough can dramatically go to the profitable area. In this case, the profit is simply fixed;

- price can permanently hover in the extreme area. However, it will periodically try to break through it, but will not be able to go far in any direction;

- at the unfavorable development of the situation, the price after making a deal on the touch of the extreme will go in the opposite direction.

Work of the expert advisor is built on the assumption that the market reversal occurs in stages, and the price almost never reverses instantaneously. At the trend reversal, the reversal patterns are usually formed, such as Head and Shoulders or Double Top. The reversal on the daily chart is often accompanied by candles with long tails.

This means that the probability is high that the price will come even closer to the extreme. This allows the expert advisor to earn, even if the price has not yet gone by 10 pips behind the extreme. The danger in this case is strong pulsed movement – the deposit can simply fail to sustain a consistent opening of multiple orders.

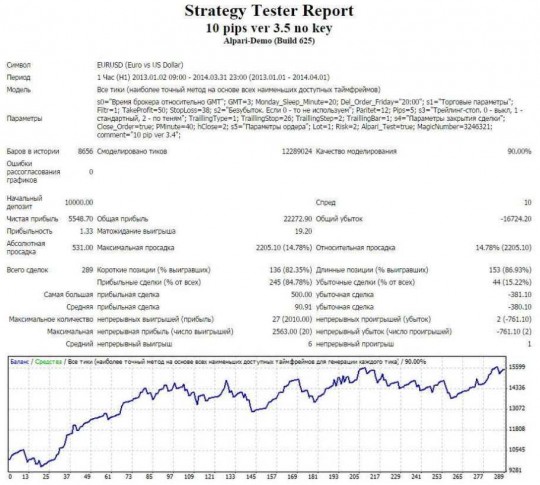

Testing of the basic version of the expert adviser

The version of the expert advisor was tested which, as the author indicates, is adapted for trading on the EUR/USD currency pair on the daily timeframe. Default settings of the expert advisor were used: SL – 30 pips, trailing stop was not used, and TP was set at a distance of 10 pips.

It is also important that the 10 Pips expert advisor pays attention solely on the price action on the first breakthrough of the daily extreme. If, for example, the price hovered in the area and 10-12 times per day crossed the high/low of the previous day, the deal will be made only 1 time.

During the 14-month testing period (from February 2013 to March 2014), at the initial deposit of $1,000, by the end of testing the profit was $5,548.7. In this case, the expectation was equal to 19.2, and the drawdown didn’t exceed 14.78%. The fact that 84.78% of open deals closed by TP speaks in favor of the working hypothesis the expert advisor is based on.

The only drawback of the basic version of the expert advisor is the not too encouraging growth curve of the deposit. Basic profit was obtained during the first 4 months of testing. The rest of the time the deposit growth chart was in a horizontal corridor. This is due to the fact that the price quite often “hover” next to the yesterday’s extreme.

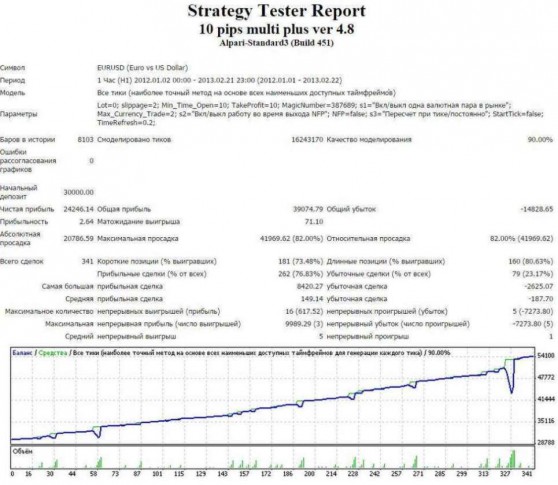

Use of Martingale to boost profitability

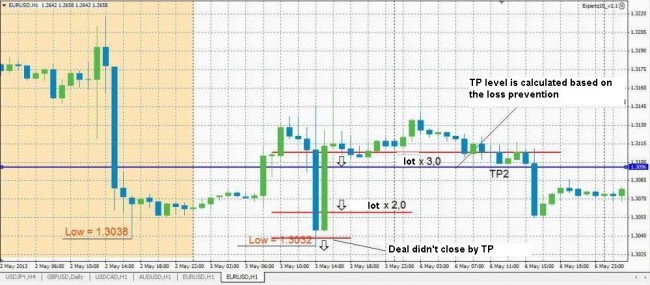

When adding Martingale to the algorithm, the 10 Pips expert advisor turns into a grid. The main idea of this innovation is that if the price after the breakthrough of the extreme immediately went in the opposite direction, there is a strong likelihood that it will come back to this level.

On this basis, the expert advisor opens orders at a certain distance from each other. This distance depends on the volatility of the pair. It also increases the lot. Thus, as soon as there is even a slight movement in the right direction, the losses are covered thanks to a large lot and position is brought to a plus.

According to the test results, it can be argued that the use of Martingale in this strategy has the right to live. On the hourly timeframe EUR/USD for 2012 and early 2013, the expert advisor made a profit in the amount of $24,246.14 (the initial deposit was $30,000).

However, large drawdowns (82%) can be called the shortcomings of this approach, but this is a typical “disease” of all expert advisors using Martingale. To work successfully with this version of the advisor, we can recommend to regularly withdraw profits and in no case violate the rules of MM.

In general, the 10 Pips expert advisor can be considered a successful use of the psychology of market participants. But that does not make it less profitable. Despite the relatively simple algorithm (at least the basic version), it is able to consistently make a profit.

Social button for Joomla