Arbitrage advisor allows to reduce the possibility of losing trades to zero. Besides, trading with its help doesn’t depend on the market situation. Deals will be made both during the pronounced trend and during the flat. The only condition for profitable trading is high volatility of the pair.

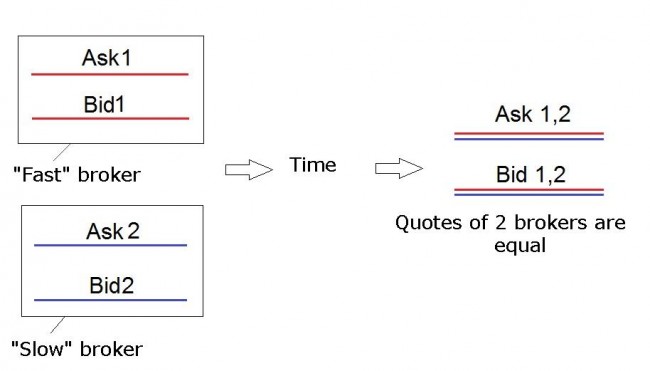

These advisors are based on delay between updating of quotations in different DCs. This mismatch does not exceed a few pips and usually is not fraudulent intent of the brokers. Update speed is primarily related to technical reasons.

Arbitrage is to buy one instrument with DC at a lower price and at the same time sell the same instrument with another DC. The deal is made only if the spread in pips between quotations of different DCs exceeds the total spreads and commissions of both companies.

This option is called classical arbitrage (two-legged). It is used in cases where the quotes of one company can in different times be ahead or behind the quotes of the other DC. If the data of one broker is constantly behind the quotes of the other, the deals can be made only with the “slow” DC.

How to use arbitrage advisor

Any arbitrage advisor automatically performs the following functions:

-

continuous monitoring of changes in quotations with the “fast” DC;

-

in the case of correlation between the two instruments close to 100%, the EA opens oppositely directed deals;

-

after the difference in quotations exceeds the spreads of both DCs, the trading robot makes a deal in the direction of the “fast” DC.

Most arbitrage advisors allow using “zero triangles” system. In this case, trading is conducted simultaneously on 3 currency pairs. For example, a long position on EUR/JPY, short position on USD/JPY and long position on EUR/USD are opened at the same time. The EA automatically calculates the lot size for each deal on the basis of obtaining a balanced position.

At first glance, such trading makes no sense, because in the end the trader will earn zero profits and losses in the form of the spread. However, sometimes there are situations on the Forex market when the balance shifts to the profitable area (this is connected with the difference in the speed of quotes updates). The EA in this situation closes all positions and fixes profit.

Arbitrage advisor: pros and cons

The main advantage of arbitrage advisors is the risk close to zero. Their advantages include the fact that trading can take place anywhere on the market – both during the trend and in the horizontal area.

Arbitrage advisor is strongly dependent on such factors as slippage and requotes. In some cases, the deal can be struck at a price different from the requested. In this case, the EA will try to minimize losses. Some trading robots set maximum support time for a losing position after which it is closed.

Requotes are dangerous because one of the DCs doesn’t open a deal but rather endlessly requests prices. This is why arbitrage advisors limit the maximum number of requotes for opening and closing positions. In some cases, trading will be conducted quite vigorously, and the DC which doesn’t allow pipsing can block the account. For this reason, some expert advisors allow you to set the minimum “lifetime” for the deal.

Social button for Joomla