Choosing the trading conception on Forex is one of the main priorities of traders. Some prefer to work on the minute charts, others choose the largest time intervals. There are traders who prefer exclusive trading, while others can easily entrust their deposit to advisors. This is because one needs both the time and the possibility to trade on Forex. In such a way, an efficient advisor needs to be chosen that could provide good trading results. This is when a trader faces the need to choose.

Prosperity advisor is one of the widely advertised advisors. First of all, it should be explained what an advisor is. It is primarily a robot tasked to trade in the market using a preprogrammed automated trading system.

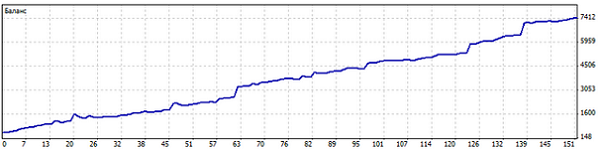

Prosperity advisor is one of such robots, designed for automatic trading at time intervals from M15 to 4H. It can easily cope with the price noise, which makes it very efficient.

One of the best advantages of this trading robot is that it works exclusively with one order at a time rather than with many at once. Moreover, the advisor will fulfill only the order which was opened by it. This provides an opportunity for parallel trading if desired. The advisor operates if the terminal is turned off, and the transaction can be closed without the Internet connection. It works not with the closing prices, as is common, but with opening prices, which is quite unusual.

The developers claim that the Prosperity advisor comprises several trading systems, which makes it universal with respect to different market behavior.

But there are other things that can characterize it from the negative side:

1. It is not free. To use this robot you have to buy it. It is unclear what brokers provide their services for: to receive commissions or to sell trading advisors.

2. The demand in relation to the deposit is not clear. If a minimum lot is 0.01, then why is it $500 or $5? This is not a problem, of course, but if the advisor concept has some side aims, then it can’t 100% answer its purpose.

3. Underlying strategies of its program are not clear either. This makes it an efficient advisor with unknown algorithms. This makes one exercise caution.

4. Finally, it remains unclear why Prosperity advisor defines a stop equal to profit in trading. Every professional trader knows that a stop should be at least several times less than profit. And if the adviser is efficient, then what algorithm does it use?

The conclusion can be made in form of a controversial issue. If Prosperity advisor due to its queerness shows positive results during testing, then can you use it without knowing its operating principle? Here everyone decides for themselves, but you will surely deprive yourself of your trading history analytics. Trading without understanding what is happening may result in huge losses.

Social button for Joomla