At a certain stage, almost every trader comes to a full or partial automation of trading. This process can be expressed in the creation of the robot based on individual trading strategy, or in the use of the ready-made solutions, one of which is the Calypso EA.

Initially, like most of its fellows, this robot was paid, but later free versions and modifications began to spread rapidly. As you know, the main reason for such turns of fate is significant weaknesses in the algorithm and similarity to other advisors.

The creators position their product as a unique algorithm and artificial intelligence able to take decisions in a changing environment. Let’s try to find out if this is true or not, and whether this advisor is worth to trust your deposit to.

Calypso EA on default settings

Before launching our test, let’s pay attention to the abundance of the robot’s parameters. Most of them have explanations in the Settings window, and we should thank authors for this, because not every advisor has such description. On this basis, we’ll only analyze the basic ones and those that are hard to apply.

Calypso EA has one dangerous parameter capable to turn the conservative trender into the averager, which is called "enable the lot multiplication factor". By default, it is enabled and configured aggressively (factor 2). Everything is fine, but in most cases this setting leads to Martingale instead of pyramiding during the operation of the EA.

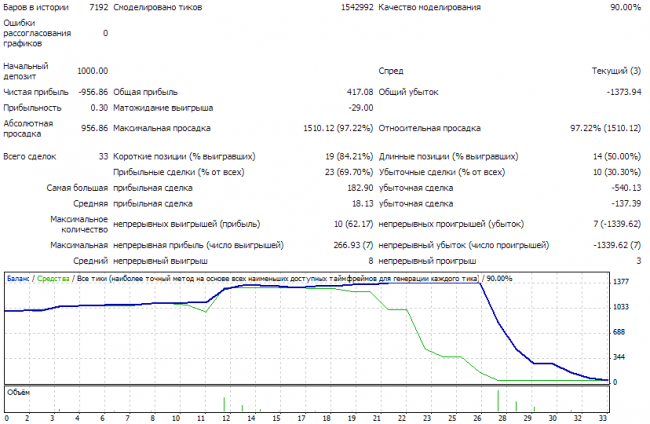

The robot itself is multicurrency and has no severe restrictions on the use of any currency pairs. Therefore, we will test it on a EUR/USD pair, and the result is presented in the figure below:

I think no comments are needed, as everything is clear: the usual behavior of the algorithm on the Martingale with predictable results. This circumstance we’ll surely take into account during the optimization.

Configuring Calypso EA for lucrative trading

As noted above, the lot multiplication was disabled: in this situation it makes no sense to change the factor, since it will siphon due to the Martingale principle anyway. This is the experience of many traders. Meanwhile, there’s nothing wrong in the averaging itself and in opening additional orders in the same lot – even large funds use such strategies. The main thing here is to choose the right period and identify trend, which Calypso EA can do on its own.

Another important parameter that needs to be enabled in order to prevent loss increase is the protection level of the deposit interest. Once the losses start to grow on a series of orders, the EA will drop them as “bad” deals.

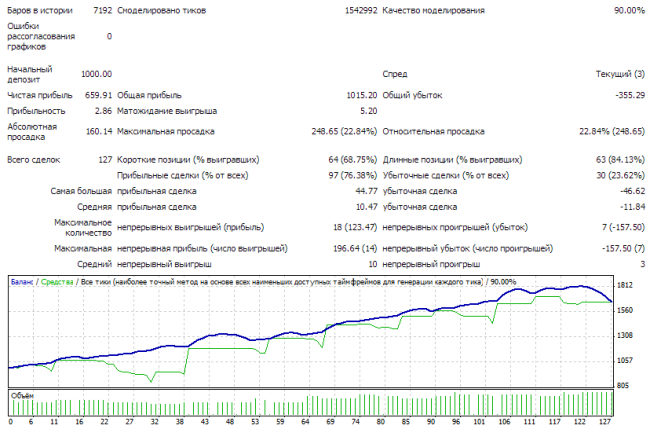

We’ll leave the Dynamic Lot settings unchanged to allow the EA to manage the risk, depending on the deposit size. With the growth of the deposit it will increase the working lot on its own, and on the contrary – with its decrease it will reduce the lot. The optimization result can be seen in the picture below:

Calypso EA: strengths and weaknesses

The main results of our review and testing are the following advantages inherent to this series of robots:

- description of the settings right at the main EA window, which makes it easy to grasp even for a novice trader;

- abundance of parameters that can be adjusted;

- ability to work on all pairs, multicurrency;

- dynamic lot, which means that it is not necessary to change the settings manually by increasing deposit: the EA will do everything on its own.

There are also some weaknesses, the main ones being the following:

- by default the robot starts working on the Martingale principle;

- it is recommended to run the EA on deposit of at least $1000, otherwise the probability of cash siphoning increases.