Perhaps, any trader has considered trading in automatic mode. This approach allows to save a lot of time while the robot is not subject to emotions and in any situation can operate only within the frames of its built-in algorithm.

All traders can be divided into 3 categories:

-

those who believe in the viability of the lucrative trading with the help of expert advisors;

-

ardent opponents of automatic trading;

-

those who take a neutral stance on the issue.

The first category includes the EA developers, people successfully trading with EAs, as well as newcomers who had no time to try their hand at the foreign exchange market yet. The opponents of the idea of automated trading are traders who lost money in the past when trying to trade with the help of expert advisors. Neutral party includes those who successfully trade with, for example, graphic or fundamental analysis and consider earnings with EA possible.

Proponents of automated trading argue that the robot won’t miss a single signal in the market, nor it can succumb to emotions. Opponents argue that it is human component that plays a major role in successful trading, and success in the Forex market is determined by the instinct. They believe that EAs can be successful only for a short time.

What determines profits from using EAs

Existing expert advisors can be classified by several criteria:

-

by timeframe (some expert advisors are optimized for scalping, others work at h1, h4 and bigger time intervals);

-

by degree of automation (those requiring manual confirmation of the deal and those trading in automatic mode);

-

those using and not using the Martingale principle.

Making profit with trading advisors depend on the ability of the trader to change its settings. In the case of automated trading, a person turns into a mechanic who must regularly maintenance the EA. Thus far, it is impossible to create an algorithm that would improve itself, so besides withdrawal of the earned money, the trader will also have to optimize the EA.

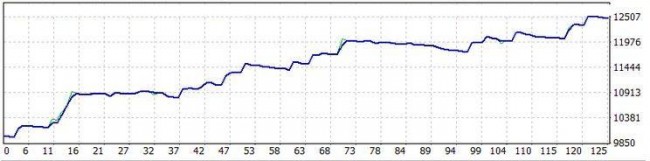

The point of optimization is to regularly test the trading robot on history and monitor its profitability. In the case of unacceptable drawdowns, its work should be stopped on a live account and stable operation achieved by changing the parameters.

How to make earnings with the EA permanent: general recommendations

We can state some rules that can improve the stability of earnings in automatic mode:

-

preference should be given to expert advisors working on timeframe above h1. Scalping advisors though sometimes demonstrate outstanding results, also require hard optimization work;

-

EAs that use Martingale should be treated with caution. In addition, they require a large initial deposit, which would withstand significant drawdowns;

The most important thing to remember is that earnings with expert advisers won’t allow to multiply your deposit within a couple of days. But it can provide an income of 5 – 20% of the deposit per month (with virtually no loss of personal time).

Social button for Joomla