An ideal neural network expert advisor must trade by itself, without human intervention at all. Regular advisor sooner or later has to be optimized, and you have to find parameters at which it begins to trade profitably. Using neural networks allows to combine the advantages of automated trading (compliance with strategy rules, independence from emotions) and learning ability (that the ordinary trading robots lack).

During the creation of any trading robot, the trader goes through such steps as:

- identification of patterns in the currency market and the formulation of clear strategy rules;

- description of the resulting trading strategy in the language understandable to the computer;

- advisor backtesting and optimization (if necessary);

- trading on demo account;

- trading with real money;

- periodic optimization to maximize profits.

Actually, you can stop here and use the gained practice for automated or semi-automated trading, but there is a temptation to divert even these functions to the computer. The advisor based on neural networks can provide such possibility, at least in theory.

How the neural network advisor works

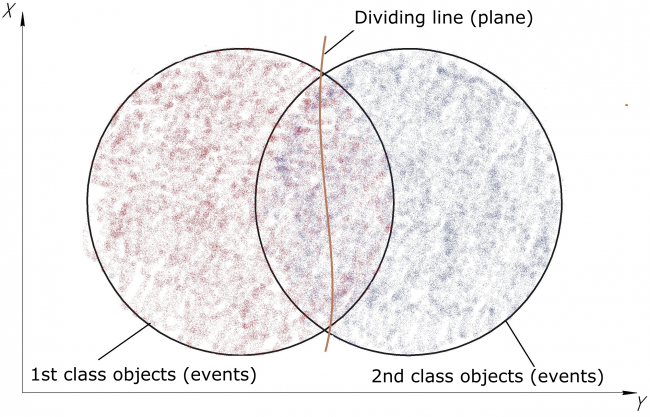

All existing neural advisors (using neural networks of any complexity and various filters) solve the same problem – the assignment of the object to a particular class. With respect to the Forex trading, the events can be classified, for example, as an uptrend (1st class event) and a downtrend (2nd class event). Neural network advisor should accurately classify events based on incoming data.

In conventional advisors, the criterion on which the classification of events is performed remains unchanged. As a result, when trends changes, it continues to trade under the old rules and successfully siphons the deposit. The advisor on the basis of neural networks should automatically recognize the new trend and change the trading rules without human intervention.

Depending on the complexity of neural advisors, the accuracy of objects classification changes as well. The simplest trading robots use a line or a plane on the optimization stage. The introduction of additional non-linear filters and their combination into multilayer neural networks allows to consider more factors and increases the accuracy of the forecast. When optimizing, the higher-order surfaces are used.

Neural network advisor: opinions of skeptics and optimists

Skeptics bring several good arguments that, in their opinion, make predicting the behavior of prices meaningless:

- the market is an open system, which means that the price chart is influenced by many factors;

- some of these factors can’t be quantified;

- reaction to the same factor may be different, that is "the effect of the crowd" plays its role.

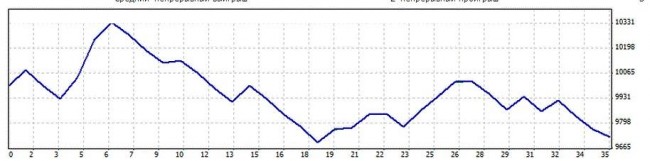

Neural network advisor, according to the optimists, is the future of trading. Their main argument is that on large timeframes the pronounced trend areas are seen. If the price movement was really chaotic, the chart would have been approaching to a straight line with the timeframe increase. This suggests that there are rules by which the market “lives” and neural networks allow to get closer to understanding them.

Nevertheless, at the present stage of development, the effectiveness of neural networks can in the best case be comparable with the results of the technical analysis and indicator strategies. You shouldn’t expect major changes in this matter until the creation of artificial intelligence, non-inferior to human.

Social button for Joomla