When searching and installing the trading robots, many traders face an unsolvable problem: the expert shows excellent results on demo accounts, but when set to a real account, it either doesn’t work at all or starts losing money.

For a long time, traders had to put up with this situation, as even cent accounts couldn’t help, which many dealing centers (hereinafter DC) handle using the same plugins as for demo accounts. By the way, there is nothing abnormal, as no one brings deals on cents to the real market, it is recognized by almost all companies, and no one hides this fact, as it can’t be the other way, because no one handles such amounts in the interbank market.

Therefore, when buying real Forex expert advisor from the seller, one had to spend money on testing in several DC. It’s not appropriate to talk about the strategy tester here, since it offers "greenhouse" conditions, and the transactions are "painted" even without re-quotes. In this regard, today it is much easier to choose robots, because monitoring of real account has become almost mandatory criterion, without which no one will even look at the product offered by the seller.

What kind of results the real Forex expert advisor shows in the tester and in practice.

The contradiction is noticeable not only in the new robots, written by unknown programmers, it is characteristic of even the experts that are recognized as some of the most reliable to date. Worldwide famous robot WallStreet is an example.

Briefly: it is designed to trade with the trend, and the best results are shown on the 15-minute chart of EUR/USD and GBP/USD pairs. The algorithm of the expert uses several standard indicators, including moving averages, ATR, CCI, et al. The authors also provided the variables responsible for enabling the automatic money management functions and limiting the operating time (trading hours).

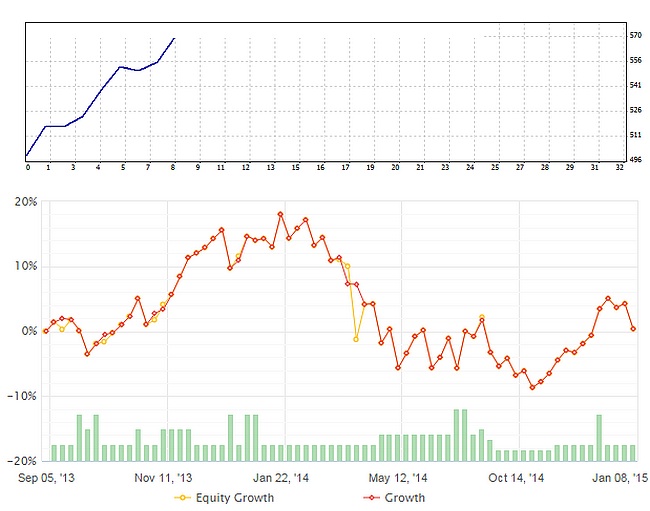

Despite the fact that the abovementioned real Forex expert advisor is really able to survive in the market and even makes a profit, the result in the monitoring of the real account deviates significantly for the worse from the performance achieved in the strategy tester:

Testing in MT4 was carried out on EUR/USD pair over the entire 2014 – as it can be seen, the expected return was not prohibitive, but perfectly acceptable – deposit growth was supposed to be 14.24% ($71.18 profit at the initial balance of $500), but in practice everything was exactly the opposite: WallStreet lost all profits earned in 2013. Summary: this robot can be used, it won’t zero the account in the long run, but you will have to reinvest the profits to cover losses incurred in difficult times.

Real Forex expert advisor ForexSetkaTrader

But the test result of the next expert will be radically different in all meanings. This is due to the fact that the algorithm is based on the grid strategy, which is less demanding on the quality of quotations and is almost independent from the policy of DC in terms of speed of orders execution and other things.

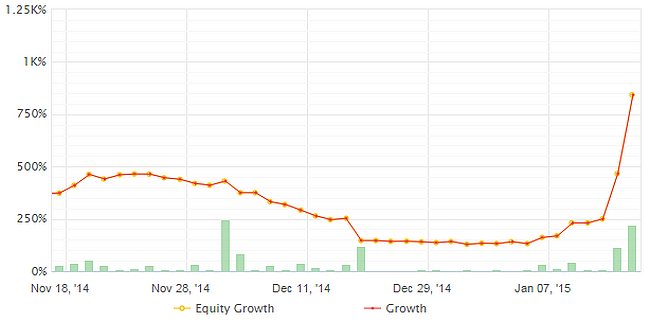

On the other hand, the Martingale, which lies in the basis of the entire trading process, can destroy deposit very quickly – in fact, it is why such robots are dangerous: if the monitoring shows excellent results, the traders start to buy the expert advisor, run it on a real account, but accidentally they fall exactly on a protracted trend that no grid consisting of limit orders can sustain.

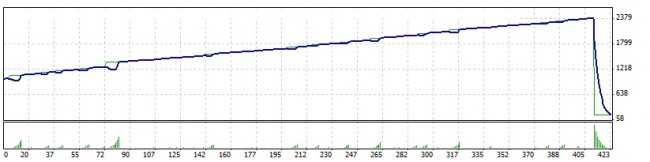

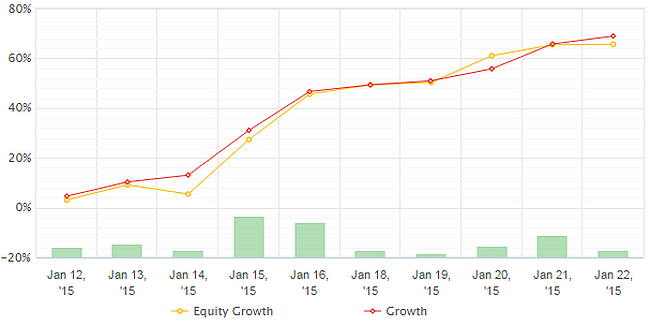

Everything becomes clear from the dynamics of funds in the account even without comments. The real Forex expert advisor was monitored since January 12, 2015 and managed to earn 65.5% for just 10 days. Perhaps this is a good option for trying to grow small deposits, followed by the withdrawal of the initial investment, but in the long run ForexSetkaTrader will face margin call.

These assumptions do not require proof, as it is the fate of all the robots of the "Ilan" class, but not to be unfounded, we give below the results generated by the strategy tester for 2014. To maintain the experimental integrity, tests were conducted on a GBP/USD pair, chosen to work on a real account with monitoring.

How to test real Forex expert advisor

The situations with WallStreet and ForexSetkaTrader bring us to a simple conclusion: when choosing a robot, you can’t ignore a strategy tester built into the terminal or real small accounts created specifically for testing. The best option in the selection of experts is the next course of action.

First, the robot is backtested only with different settings. Be sure to test the flat and trend sections separately and assess what results a real Forex expert advisor can show when you open only long or only short positions. In the first stage of the test, monitoring should be ignored, because the seller of the robot can simply adjust the parameters to get a high percentage of the profit on the account used for advertising.

Once weaknesses of the algorithm were identified in the tester, we can see how the result correlates with the dynamics of "Tools" indicator in the monitoring for the same period. The key here is to assess the magnitude of drawdown, which professionals always seek to minimize.

Consider the procedure at the example of the XMT-scalper robot

Before writing this article, we came across an interesting robot intended for trading on the minute charts. It is no secret that the M1 is the most difficult timeframe for testing, since the tester does not consider slips, lost connection and slow speed of order execution.

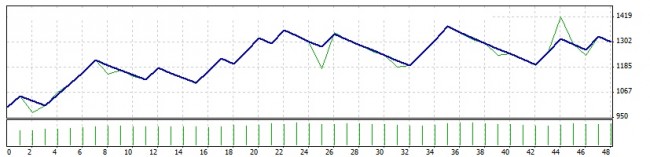

To test its viability, let’s run at least the last few months in the tester (from 29.10.2014 to 22.01.2015), because if the robot siphons off at backtesting, this process will be even faster on a real account. By the way, XMT-scalper is optimized for the EUR/USD pair.

The result was satisfactory – estimated profit for three months amounted to about 30%, while the expert always sets a stop loss and does not use Martingale tactics. Therefore, you can now take the time to search the results shown by the real Forex expert advisor in practice. To our surprise, we managed to relatively quickly find a "live" monitoring of this expert advisor on the myfxbook portal:

As you can see, the result of XMT-scalper trading in actual accounts for the same period was similar to the test data, there are exactly the same series of losing trades, which are followed by large profits covering all the losses in just a few trades.

Of course, some variations are also present, but they are due to different money management (the setting is more aggressive at monitoring), and the very specific nature of the tests on the minute charts, which we have already mentioned above. As a result, we can conclude that the expert is ready for operation.

Social button for Joomla