Every trading system has a mechanism for transactions in the foreign exchange market. First of all, any algorithm of opening positions depends on the logic of the trading strategy. If the system is focused on the work of the signals of volatility breakout or moving averages, it's usually open positions in the market, that is, the current market quotations provided by the dealer. And here, for example, the algorithms designed for testing of significant levels of support and resistance, often use pending orders.

Accordingly, Counsel, which offers deals on this principle is called - Advisor pending orders. In the trading system subject to certain conditions, as a result of which the adviser will place the application itself to purchase or sell. Before we consider as an example of a couple of these advisors focus on the standard classification of pending orders.

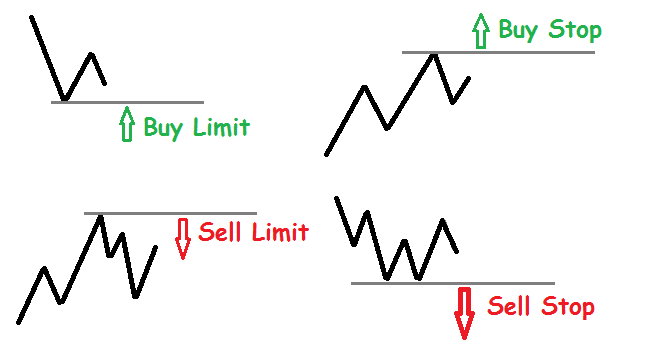

In today's trading terminals, the following types of applications with deferred settlement:

Buy limit - this order, make purchases in the event that quotation «Ask» reaches a predetermined value. The price level at the time of issuing such an order higher than the set in the application. Thus, this type of order is good to use when the expected decline in the market and there is an intention to buy.

Buy Stop - this order is the same as the Buy Limit, makes a purchase, but now the current price should be lower than the one set in the application. That is, if the trader suggests that after a certain level and the price will continue to rise further, the exhibit buy stop.

To Sell - orders is similar. Plus the use of automated trading systems to trade in this style is that the advisor pending orders independently makes modification and control of this kind of applications.

Examples of advisers.

On the Web can be found and paid trading systems, and counselors in the public domain. The following briefly describe some members of the class of trading algorithms.

Adviser pending orders BURN. This system operates at an hour interval. BURN places pending orders once in a single trading session. Orders are placed in both directions set in the parameters adviser distances from the values open a separate trading session. At the same time opening the installation pending orders, the adviser determines the values of Stop Loss and Take Profit at each position. The robot monitors the break-even level, and depending on it already exhibits the general portfolio constraints on profit and loss. Closing the position is made exclusively for Trailing-Stop-Loss.

Adviser pending orders Retailers. This trading robot is designed to accommodate the entire network of pending applications. Job advisor is directly dependent on the configuration of the main parameters:

Takeprofit, stoploss - These settings determine the risk-return trade adviser.

Lots - is the size of the lot, which is used in limit orders.

Step - The distance, measured in points, between orders.

Neworders - this option is a toggle switch activate the save function of a particular pattern of the current grid orders.

Countorders - total number of pending orders online. All orders advisor may be closed at one point using a special function.

It's not all the parameters and nuances of the adviser and exemplary components.

Any pending orders adviser has additional technical risks associated with the failure of applications. In this regard, it's necessary to harmonize the use of a particular automated trading system with a broker.

Social button for Joomla