Existing expert advisors can be classified by the working timeframe as pipsing and medium-term (trading on h1, h4, or larger time interval). Both types of trading robots have their own advantages, and the absence of a human involved in the process allows to eliminate the emotions in trading.

Medium-term trading is characterized by greater reliability, often showing a substantial profit. Even if the advisor for h4 makes only one deal a week, in the case of a successful entry, profit can amount to several hundred pips. Over the same period, the pipsing EA may make several hundred deals, fixing the profit of a few pips. At its best, profit in these examples can be comparable.

Expert advisor for h4 to a lesser extent depends on random price fluctuations, besides, this type of trading robots has better survival rate. Optimization will, of course, be required sooner or later, because the market laws are constantly changing. Pipsing expert advisors in this case are in a losing position. To maintain their working efficiency, a regular hard work on finding the operating parameters is required.

How to choose and install expert advisor for h4

When choosing the EA, you should focus on such parameters as profitability, expected payoff, maximum drawdown and the total loss during testing. Trading on the h4 time interval implies larger SL than when trading on the m1-m15 intervals. Therefore, when choosing a particular EA, you need to soberly assess the size of your deposit and whether it can withstand the possible drawdown.

You should mentally be ready for a much lower frequency of deals than when trading on the m1-m15 intervals. However, the profitability of the proper advisor is not affected. From an economic point of view, it is much more efficient to make one deal and fix profit of 150 – 200 pips than close 30 – 40 deals with the profit of a few pips. In the latter case, the loss on spread will be much larger.

Finally, the advisors working of the timeframe above h1 are supported by the fact that many DCs are wary of scalping advisers that make a large number of deals during the trading session.

Expert advisor for h4 and m15 – comparison of test results

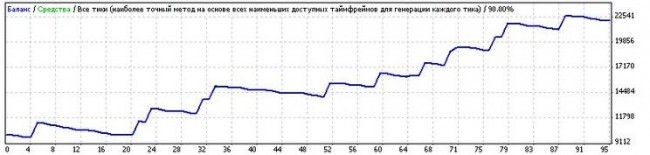

For comparison, we selected Turtle Soup (recommended timeframe h4) and 6-8 GMT Breakout advisors (working time interval m15). Testing has been performed throughout the year. The test results showed that the advisor for h4 over the year increased the initial deposit of $10,000 to $12,192.4. To do so, it made 95 deals. At the same time, the expert advisor trading on the m15 time interval made 297 deals per year and increased the initial deposit up to $15,916.

Nevertheless, the advisor trading on h4 seems more preferable, although it slightly outperformed in terms of profit over the year. Its expected payoff is 2.4 times larger than the competitor’s, and the appearance of the chart shows the reliability, over the year it has been steadily increasing profits. At the same time, the advisor trading on m15 entered the stage of stagnation in the second half of the year and ceased to trade profitably.

This confirms the high survival rate of medium-term expert advisors. The disadvantages of their use can include only the comparatively low frequency of deals and the need to have a substantial deposit which would be able to withstand the drawdown.

Social button for Joomla